Talking Points:

- Gold prices may erase intraday losses after BOE opts against rate cut

- Crude oil prices treading water in a narrow range above $44/bbl figure

- Upbeat US data may boost risk appetite, punish gold as crude oil gains

Gold prices recovered to erase most intraday losses and crude oil prices retreated from session highs alongside stock prices after the Bank of England opted against an interest rate cut yesterday. The move appeared to undermine risk appetite among traders yearning for something to soother post-Brexit jitters.

The markets’ mood seems to be rosier overnight as investors look beyond the initial knee-jerk reaction to the BOE’s quasi-promise of stimulus expansion in August. Commodities are treading water however, waiting for a more potent catalyst to drive directional momentum.

US economic data may offer a trigger. US Retail Sales data is expected to show receipts growth slowed in June (0.1% vs. 0.5% prior) while July’s University of Michigan Consumer Confidence gauge is seen holding unchanged.

News-flow out of the US has increasingly outperformed relative to forecasts since mid-May, opening the door for upside surprises. The WTI contract may rise with share prices amid swelling risk appetite in such a scenario while bonds retreat, pushing yields higher and undermining the appeal of on precious metals.

Will gold prices continue to rise in the third quarter? See our forecast here !

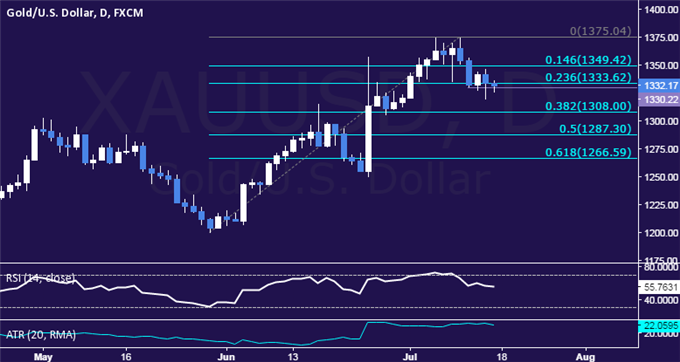

GOLD TECHNICAL ANALYSIS – Gold prices are attempting to breach support in the 1330.22-32.17 area (July 12 low, 23.6% Fibonacci retracement). A daily close below this barrier exposes the 38.2% level at 1308.00. Alternatively, a rebound above the 14.6% Fib at 1349.42 paves the way for a retest of the July 11 high at 1375.04.

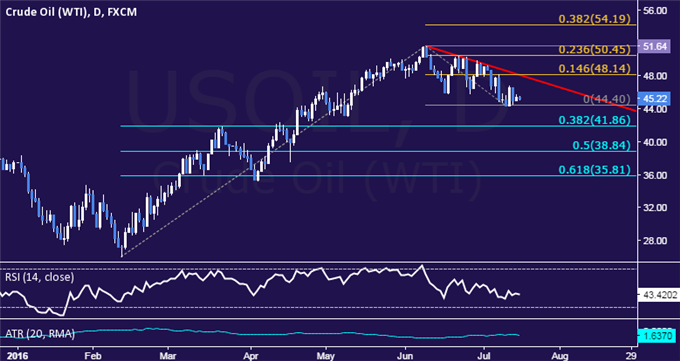

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices continue to tread water having found support above the $44/bbl figure. From here, a rebound above 48.14 (falling trend line, 14.6% Fibonacci expansion) sees the next layer of resistance in the 50.45-51.64 area (23.6% level, June 9 high). Alternatively, a daily close below the July 11 low at 44.40 exposes the 38.2% Fib retracement at 41.86.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak