Talking Points:

- Crude oil prices rebound but bearish breakout still intact

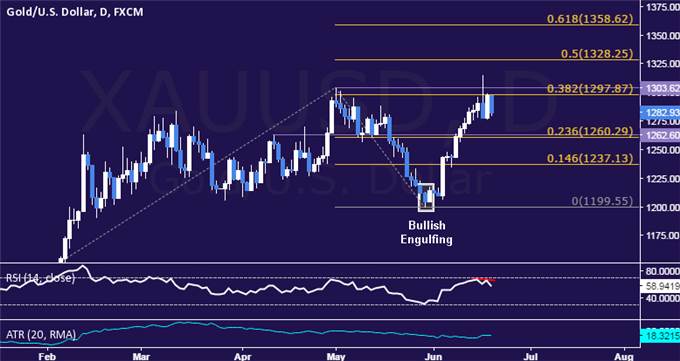

- Gold prices may be forming a double top near $1300/oz

- “Brexit” polling drives commodities as referendum looms

Crude oil prices tracked stocks higher while gold prices plunged alongside US Treasury bond futures and the Japanese Yen as a new set of polls released over the weekend hinted at ebbing “Brexit” support ahead of the UK EU membership referendum on June 23. Looking ahead, a quiet economic calendar offers little by way of countervailing event risk and S&P 500 futures are pointing decidedly higher, suggesting more of the same is likely in the hours ahead.

Still, it ought to be kept in mind that investors’ mood may swiftly sour if “Brexit” worries swell anew however. As it happens, ICM is due to publish another poll today. Last week’s tally had the Leave campaign ahead by 5 percent among respondents queried separately via telephone and online. A similar result this around may undermine risk appetite anew, sending overnight trends into reverse.

Did crude oil and gold trade as DailyFX analysts expected in 2Q? Find out here !

GOLD TECHNICAL ANALYSIS – Gold prices may be forming a double top near the $1300/oz figure as negative RSI divergence warns of ebbing upside momentum and hints a downturn is ahead. A daily close below the 23.6%Fibonacci expansionat 1260.29 targets the 14.6% level at 1237.13. Alternatively, a move above the 1297.87-1303.62 area (38.2% Fib, May 2) exposes the 50% level at 1328.25.

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices corrected higher – snapping a six-day losing streak – but fell short of overturning a break of four-month rising trend support. A daily close above this barrier, now at 48.28, opens the door for a test of a horizontal pivot at 49.73. Alternatively, a push below the 23.6% Fibonacci retracement at 45.60 exposes the 38.2% level at 41.86.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak