Talking Points:

- Crude oil prices break monthly uptrend, expose support near $42/barrel

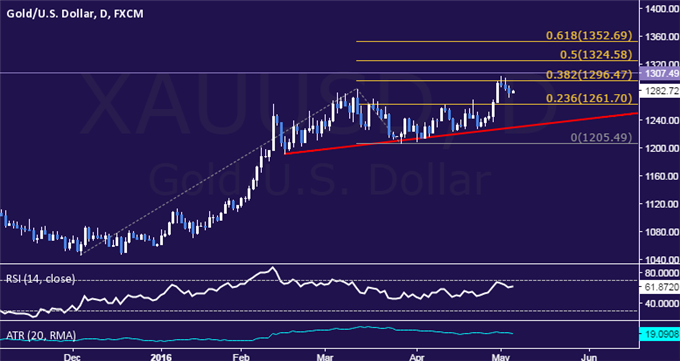

- Gold prices in corrective mode after testing resistance near 3-month high

- Directional commitment likely to wait for Friday’s US employment data

Crude oil prices have pulled back from six-month highs alongside retreating stock prices. The move seems to reflect a broad-based moderation in risk appetite ahead of Friday’s much-anticipated release of April’s US Employment report.

A concurrent moderation in priced-in 2016 FOMC rate hike expectations implied in Fed Funds futures suggests the markets are positioning to evaluate the outcome at face value. This implies that a soft result will be interpreted as negative for sentiment trends even as it argues for a more dovish monetary policy stance.

Interestingly, gold prices have pulled back from three-month highs despite deterioration in the outlook for interest rates, which might have been expected to boost anti-fiat assets. This may speak to the broadly corrective mood in Fed-sensitive assets ahead of the US jobs data release.

Absent unexpected headline risk, pre-positioning flows are likely to remain in focus into Wall Street Friday morning. Commentary from James Bullard, Dennis Lockhart and John Williams – Presidents of the Fed’s St. Louis, Dallas and San Francisco branches respectively – may stir interim volatility. Officials’ penchant for hedged rhetoric will probably limit lasting follow-through however.

Are DaliyFX analysts expecting a larger crude oil recovery? See our forecast here !

GOLD TECHNICAL ANALYSIS – Gold prices are edging cautiously downward after finding resistance in the 1294.26-1307.49 area, marked by the January 22, 2015 high and the 38.2% Fibonacci expansion. The first layer of support is at 1261.70, the 23.6% level, with a break below that on a daily closing basis exposing a rising trend line at 1229.07. Alternatively, a push above resistance targets the 50% Fib at 1324.58.

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices declined after a Spinning Top candlestick identified earlier in the week developed into a full-blown bearish Evening Star pattern. A breach of trend line support guiding the upswing from the early-April swing low suggests a larger downward reversal may be in the cards. A daily close below the 41.87-42.35 area (March 22 high, 38.2% Fibonacci retracement) exposes the 50% level at 40.99. Alternatively, a push above the 14.6% Fib at 45.07 opens the door for a retest of the April 29 top at 46.76.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak