Talking Points:

- Oil is vulnerable on the downside as EIA’s report showed prolonged demand weakness

- Gold tumbled while US dollar recovered and inflation steadied before ECB meeting

- Copper rebounded on falling Chinese output, Asian equities gains

Weekly report from the U.S. Energy Information Administration was the highlight in oil market yesterday. Prices slid below 45 to a three-week low as crude stocks continued to expand by 8.03 million barrels.

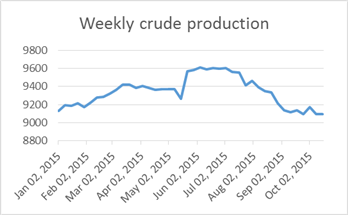

Historical data in the report reflected consistent weakness in demand, as production has been falling since August while stocks were on the rise during the same period.

Charts of data from EIA

Demand is also potentially hurt by a reduction in gasoline profit margins, which deters refiners from running at higher capacity and consuming crude oil in the process. This margin, or gasoline crack spread, slumped to the lowest since 2010 last week. Gasoline output last week dropped to 1.58 million barrels a day from 1.62 million barrels in the week before.

The below chart shows Gasoline RBOB spread futures, an exchange-traded contract for crack spread, at multi-year low.

Active Gasoline RBOB spread futures traded on NYMEX. Source: Bloomberg

Gold tumbled below 1165 and heads to test last Thursday low at 1163.40 as US dollar recovered moderately, despite equities losses in Europe and US. Steadily low inflation rates have eased the need for gold as a store of value.

Gold prices will likely stay weak on the downside coming to next week given neutral-to-hawkish expectations for the upcoming central bank meetings: ECB today and U.S. Federal Reserve next week.

Copper rebounded slightly from its two-week low at 2.3305 yesterday, together with gains in Asian equities. Futures in Shanghai exchange climbed for the first time in five days at sign that September refined copper output in China grew at the slowest pace in this year. The situation will likely prolong given maintenance schedule of Chinese smelters in October.

GOLD TECHNICAL ANALYSIS – Gold displays a downside bias that may lead to a breach of an intraday support at 1163.40. Prices set on a downturn with downward momentum building up. Next support level comes at 1156.8 then 50% Fibonacci at 1151. Intraday prices is currently range-bound in 1163.4-1169.

15-minute Chart - Created Using FXCM Marketscope

COPPER TECHNICAL ANALYSIS – Copper rose for the first time after four consecutive days of decline. As we noticed before, a rebound in momentum signals indicate higher moves ahead. The bulls and bears alike should keep watch of a resistance level and also 23.6% Fibo at 2.3775.

Daily Chart - Created Using FXCM Marketscope

CRUDE OIL TECHNICAL ANALYSIS – Oil also stalled a 3-day decline with a slight gain at the middle of the 43.59-47.21 range (23.6% Fibo to 38.2% Fibo of the April-August fall). Nevertheless, oil is vulnerable on the downside, given downward momentum signals. Range trade continues to dominate the bets while oil stays range bound.

Daily Chart - Created Using FXCM Marketscope

--- Written by Nathalie Huynh, Currency Strategist for DailyFX.com

Contact and follow Nathalie on Twitter: @nathuynh