This daily digest focuses on market sentiment, new developments in China’s foreign exchange policy, changes in financial market regulations and Chinese-language economic coverage in order to keep DailyFX readers up-to-date on news typically covered only in Chinese-language sources.

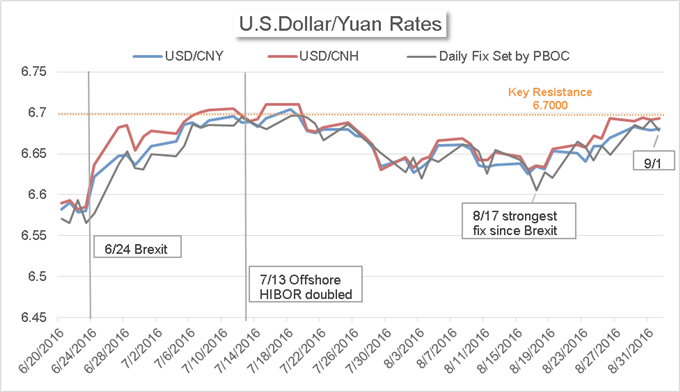

- The gap between onshore and offshore Yuan rates widened following the PBOC’s guidance.

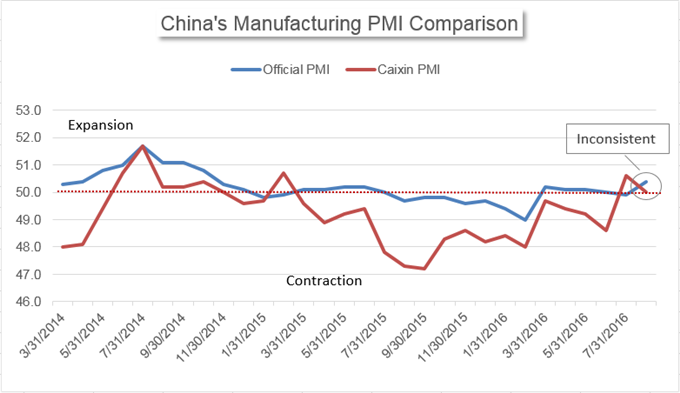

- The official PMI print showed improved demand while is contradicting to Caixin PMI read.

- The PBOC Deputy Governor commented on Yuan rates at G-20 press briefing.

To receive reports from this analyst, sign up for Renee Mu’ distribution list.

Sina News: China’s most important online media source, similar to CNN in the US. They also own a Chinese version of Twitter, called Weibo, with around 200 million active usersmonthly.

- The PBOC strengthened the Yuan by +124 pips or +0.19% against the U.S. Dollar on Thursday. Both onshore and offshore Yuan rates moved higher following the release but the spread between the two rates elevated. As of 10:45am EDT, the gap has widened to 154 pips from 77 pips before the release of the daily fix.

Data downloaded from Bloomberg. Chart Prepared by Renee Mu.

Hexun News: Chinese leading online media of financial news.

- China’s official manufacturing PMI gauge in August came in better-than-expected and back to the expansion territory, at 50.4. This is also the strongest level since November 2014. In February, the official manufacturing PMI dropped to the lowest level since 2011.

Data downloaded from Bloomberg. Chart Prepared by Renee Mu.

Among the sub-indexes of the PMI measure, production and new order indexes increased in August, indicating both supply and demand in the manufacturing sector has improved. This is a positive sign for the traditional sector, as in the short-term, cutting production may be a solution for firms to survive in the economic winter. However, eventually they need to expand their business in order to develop and succeed; this will require improved demand.

At the same time, the Caixin Manufacturing PMI print released 45 minutes later moved into the opposite direction of the official read. The August Caixin PMI print fell to 50.0 from 50.6 in the month prior. This is not the first time the two PMI reads are contradictory to each other. Last month, Caixin PMI was higher than the official PMI. This is likely caused by the differences amongst surveyed companies that are included in the two reports: official PMI report covers large, medium and small-sized companies, while Caixin PMI focuses on small and medium-sized companies.

Data downloaded from Bloomberg. Chart Prepared by Renee Mu.

China Finance Information: a finance online media administrated by Xinhua Agency.

- The Deputy Governor of the PBOC Yi Gang commented on Yuan rates at a press briefing for the G-20 meetings on September 1st. Mr. Yi said that the volatility in the Yuan is lower than other reserve currencies; Yuan rates have been floating within a reasonable range and remain relatively stable. He also addressed that China’s Central Bank will maintain a market-oriented exchange rate regime and continue to improve the system.

G-20 meetings are being held in Hangzhou, China, beginning on August 31st. The most important meeting for traders to keep an eye on is the G-20 Leaders Summit that is scheduled on September 4th and 5th.

| G20 Meetings (September 2016) | ||

|---|---|---|

| August 31 - September 1 | Finance and Central Bank Deputies Meeting (communique drafting) | Hangzhou, China |

| September 1-2 | Sherpa Meeting #4 (communique drafting) | Hangzhou |

| September 2 | Joint Sherpas and Finance Deputies Meeting (communique drafting) | Hangzhou |

| September 3-4 | B20 Summit | Hangzhou |

| September 4-5 | G20 Leaders Summit | Hangzhou |

Source: G20 official website.

To receive reports from this analyst, sign up for Renee Mu’ distribution list.