Australian Dollar, AUD/USD, FOMC, US Dollar, Iron Ore, Retail Sales - TALKING POINTS

- Australian retail sales in focus as iron ore prices gain momentum

- FOMC announcement sees Fed rate hike bets fall, dragging on the USD

- AUD/USD eyes wedge breakout target after strong overnight gains

Thursday’s Asia-Pacific Outlook

Asia-Pacific markets are set to trade higher after a rosy New York trading session. Traders moved into risk assets following the Federal Reserve’s policy announcement. The market trimmed future bets on aggressive rate hikes, dragging on Treasury yields and the US Dollar. The tech-heavy Nasdaq-100 Index (NDX) rose more than 4%.

Iron ore prices rose in China despite a new wave of Covid lockdowns in Wuhan, where a million people were ordered to stay in their homes over the next three days. The higher iron ore prices and broader US Dollar pullback boosted AUD/USD. Rio Tinto Group—an Anglo-Australian mining company—cut its dividend by 50%, which saw its stock price fall in European trading. The iron ore miner announced that it is close to a breakthrough on a new source of iron from Guinea after negotiating a deal with the country’s government.

The US Energy Information Administration (EIA) reported a large draw in crude oil and gasoline stockpiles in its latest weekly inventory report. That pushed crude oil prices higher. European gas prices rose amid falling flows from the Nord Stream 1 Pipeline. Russia’s Gazprom appears ready to follow through on further reductions to Europe. The high prices have eased the financial burden on Russia even as it moves less natural gas to Europe.

New Zealand’s business confidence index from ANZ will see an update today. The New Zealand Dollar rose against the US Dollar overnight. Australia’s retail sales for June are due out, with analysts expecting a 0.5% month-over-month increase, down from 0.9% m/m. A bright print may help the Aussie Dollar extend gains as it would underpin optimistic hopes for the Australian Economy.

Notable Events for July 28

Japan – 2-Year JGB Auction

AUD/USD Technical Outlook

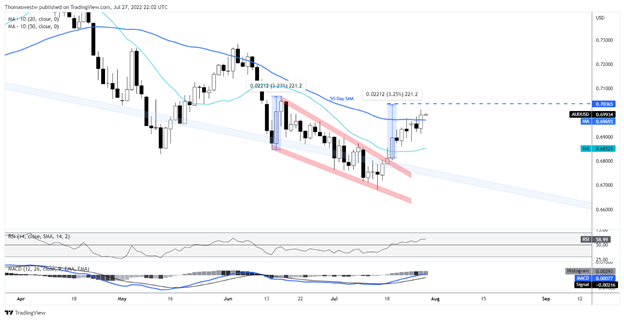

AUD/USD rose above its 50-day Simple Moving Average and is on track to hit its post-wedge breakout target of 0.7036. The MACD oscillator made a bullish cross above its midpoint on the daily chart and the Relative Strength Index is tracking higher above its midpoint. The 0.7000 psychological level may see some conflict in prices.

AUD/USD Daily Chart

Chart created with TradingView

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter