Bitcoin, BTC/USD, Market Sentiment , Australian Dollar, RBA, Technical Forecast - Talking Points

- Bitcoin Prices take a big hit as US equity markets sink after traders digest FOMC

- RBA policy statement in focus, but APAC traders to remain cautious before US NPF

- BTC/USD prices may drop to the 2022 low after prices pierced below a key Fib level

Asia-pacific markets look set for a bearish session to close out the week after risk assets plummeted overnight during the US and European trading sessions. Bitcoin and other cryptocurrencies joined the selloff in equity markets, with BTC/USD sinking more than 9%. That dragged prices to the lowest levels traded at since February 24.

A climbing US Dollar is also helping to push down BTC prices. The DXY Index reversed course overnight following an initial drop in response to the Federal Reserve’s interest rate decision. The British Pound’s sharp move lower contributed to a lot of weakness in the Dollar index, with GBP/USD sinking more than 2% to the lowest since June 2020. The Bank of England signaled a weaker outlook in its latest policy decision, which punished the Sterling as recession fears intensify.

The risk-sensitive Australian Dollar joined the risk-off move, pushing AUD/USD nearly 2% lower. That erased a large chunk of its post-RBA gains. A sharp contraction in China’s services PMI reported by Caixin earlier this week is also weighing on the Aussie Dollar, given China and Australia’s trade relationship. This morning, the country’s AiGroup Services Index for April rose to 57.8 from 56.2 in March. Iron ore prices are more than 1% lower in Singapore this morning, adding additional pressure on AUD. APAC traders will be on watch for today’s Monetary Policy Statement from the RBA due out at 01:30 GMT.

Japan will see Tokyo’s consumer price index (CPI) cross the wires this morning. Singapore will follow with April’s purchasing managers’ index (PMI) from S&P Global. The Philippines’s March unemployment rate and balance of trade data is also expected to drop. Traders may be cautious ahead of tonight’s US jobs report. Analysts expect the non-farm payrolls report for April to increase by 380k, according to a Bloomberg survey.

Bitcoin Technical Forecast

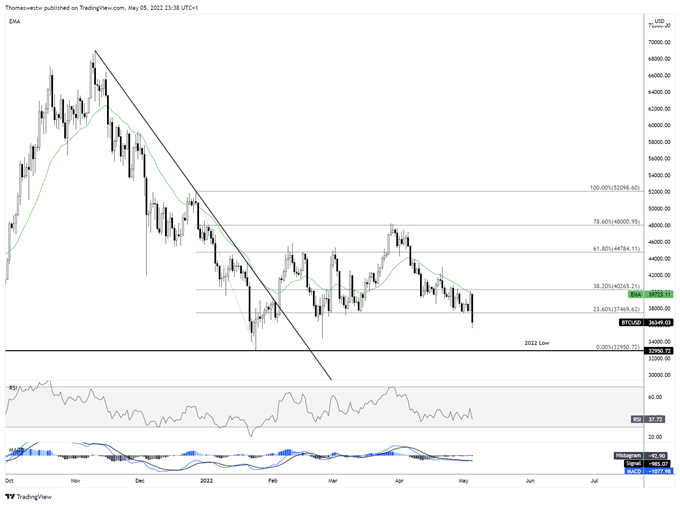

Bitcoin prices may soon threaten the 2022 low from January at 32,950.72 after breaching below the 23.6% Fibonacci retracement level. The pivot lower began after bulls failed to clear the falling 26-day Exponential Moving Average (EMA) during Thursday’s bounce. Overall, the bearish trend looks set to continue, but buyers may become more confident near the 2022 low.

BTC/USD Daily Chart

Chart created with TradingView

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter