Australian Dollar, AUD/USD, Fed, RBA Lowe, NZD - Talking Points

- Asia-Pacific markets may struggle today after US stocks drop on CPI

- RBA Chief Philip Lowe opines against lofty rate hike expectations

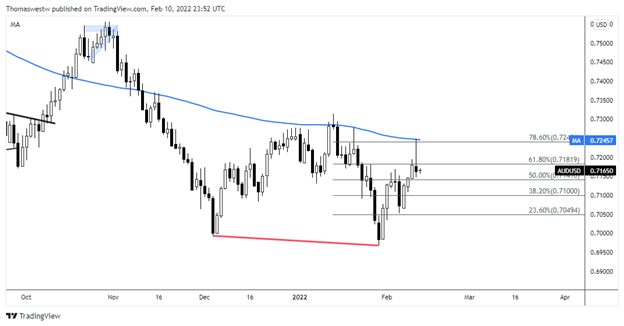

- AUD/USD fails to clear 61.8% Fib level after pinging the 50-day SMA

Friday’s Asia-Pacific Outlook:

The Australian Dollar trimmed gains versus the US Dollar overnight after the pair hit the highest level since January 2, pushing the exchange rate lower into Asia-Pacific trading. A red-hot inflation report out of the United States bolstered rate hike bets, pushing the US Dollar and Treasury yields higher and pulling down the Dow Jones Industrial Average by 1.47%.

The risk-off sentiment may bleed over into APAC trading today, capable of dragging Asian equity indexes lower, eating into gains set earlier in the week. The Australian Dollar came under more pressure this morning after RBA Governor Philip Lowe pushed back against hawkish market expectations. The RBA Chief signaled that moving too early on a rate hike would include risks, including a hit to the labor market.

New Zealand reported mixed economic data this morning. The Business NZ PMI for January fell from 53.8 to 52.1. Electronic retail card spending rose 3.0% in January on a m/m basis, up from 0.3% m/m in December. Those numbers suggest that domestic consumer demand is increasing in the island nation, a likely result of Covid restrictions being gradually removed in recent months.

The Kiwi Dollar is nearly unchanged versus the Greenback after moving slightly lower in overnight trading. Later today, NZD may move on business inflation expectations for the first quarter, due out at 02:00 GMT. China is set to report vehicle sales (Jan), and Taiwan’s January trade balance will also cross the wires. India will wrap up the day with industrial production data (Dec) at 12:00 GMT.

AUD/USD Technical Forecast

AUD/USD popped and dropped overnight, failing to defeat the 61.8% Fibonacci retracement for the second day on an intraday move and just clipping the 50-day Simple Moving Average (SMA). The pseudo 50% Fib level may turn to support after prices struggled to clear above the level last week. Prices may consolidate to wrap the week up, given the light economic docket today.

AUD/USD - Daily Chart

Chart created with TradingView

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter