New Zealand Dollar, NZD/USD, Wall Street, Tech Earnings, AUD/USD, RBA – Talking Points

- New Zealand Dollar gained as rosy market sentiment boosted pro-risk currencies

- However, dismal Amazon and Apple earnings offer sour tone for Friday Asia trade

- Australian Dollar eyeing retail sales after RBA withheld from keeping YCC in check

Thursday’s Wall Street Session

The sentiment-linked New Zealand Dollar gained on Thursday as Wall Street tech stocks closed at a fresh record high, with the Nasdaq 100 index rising 1.15%. However, lackluster earnings from Amazon and Apple crossed the wires after the closing bell, which saw both stock prices sink in after-hours trading. That downside price action may extend into Friday’s New York session.

Despite the gloomy figures from Amazon and Apple, corporate earnings on a broader scale remain mostly positive. That said, other warning signs over the global economic rebound’s strength are coming into question. United States third-quarter GDP growth came in at 2.0% overnight, which was well below the consensus analysts’ estimate of 2.7%, and down sharply from 6.7% in the previous quarter.

The disappointing US economic data sent front-end Treasury yields falling, likely cooling hawkish Federal Reserve monetary policy expectations. This and the generally rosy mood on Wall Street weakened the haven-linked US Dollar. Meanwhile, the Euro outperformed its major peers in the aftermath of a more hawkish-than-expected European Central Bank monetary policy announcement.

Friday’s Asia Pacific Session Outlook

Nasdaq 100 and S&P 500 futures are pointing lower heading into Friday’s Asia-Pacific trading session. This is weakening the sentiment-linked Australian and New Zealand Dollars. AUD/USD will be closely watching Australian retail sales after the RBA withheld from keeping the 3-year yield target in check yesterday. This has further reduced dovish policy bets, and a strong retail sales print could amplify that dynamic ahead of next week’s RBA rate decision.

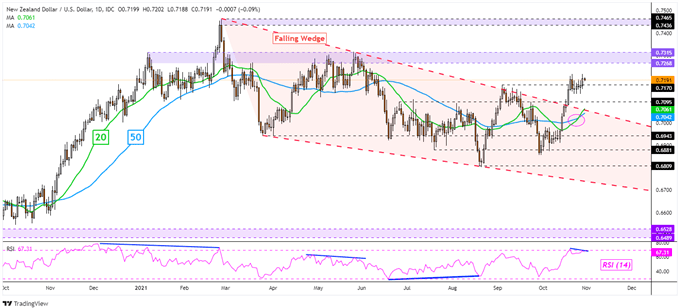

NZD/USD Technical Forecast

Recent gains in NZD/USD have kept it around the 0.72 psychological level after the New Zealand Dollar broke above a bullish Falling Wedge chart formation. Negative RSI divergence has emerged, showing fading upside momentum. A turn lower may place the focus on the 20- and 50-day Simple Moving Averages. A bullish crossover emerged recently, offering an upside technical bias. Further gains may place the focus on the 0.7268 – 0.7315 inflection zone.

NZD/USD Daily Chart

Chart created with TradingView

--- Written by Thomas Westwater and Daniel Dubrovsky, Analyst and Strategist for DailyFX.com, respectively

To contact Thomas, use the comments section below or @FxWestwater on Twitter

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team