Australian Dollar, AUD/USD, China, Coal, Crude Oil, BOK – Talking Points

- Australian Dollar rises overnight versus USD despite Wall Street stocks closing lower

- Chinese floods force mines to close, sending coal prices surging higher in Asia

- AUD/USD looks to hold above the 50-day SMA after strong overnight gains

Tuesday’s Asia-Pacific Forecast

The Australian Dollar remains on a solid footing after gaining overnight despite a weak performance in US stocks on Wall Street. The Dow Jones Industrial Average (DJIA) closed 0.76% lower on Monday. Rising energy costs are fueling concerns that inflation may be stickier than most economists and central bankers have predicted. Those higher costs could very well eat into consumer spending in other parts of the economy. A downbeat GDP report from Goldman Sachs also weighed on sentiment. The US bank cut its growth target to 5.6% for 2021.

AUD/USD rose as coal prices surged in Asia. Beijing ordered energy producers to increase production last week, which relieved some upward pressure on prices. However, flooding across China is halting mining operations. That sent coal futures in China to record highs on Monday, which lifted the Australian Dollar. Australia is a major coal exporter, and China has reportedly allowed small amounts to clear customs despite a ban on coal imports from the southern neighbor.

Oil prices also rose overnight, further spurring inflationary concerns as crude oil hit its highest level since October 2014. The demand for energy products is rising as economies come back online following Covid restrictions put in place versus the highly contagious Delta strain. New South Wales, Australia’s most populated state, loosened restrictions on Monday. Vaccination rates in Australia have seen significant progress in recent months, allowing the reopening.

Elsewhere, New Zealand reported a 0.9% rise in electronic card spending for September on a month-over-month basis. Later today, Japan will report bank lending and producer prices data for September. The Bank of Korea (BOK) is set to keep its benchmark interest rate on hold at 0.75%. Traders will also have a close eye on the United Kingdom’s July employment report in the European session.

AUD/USD Technical Forecast

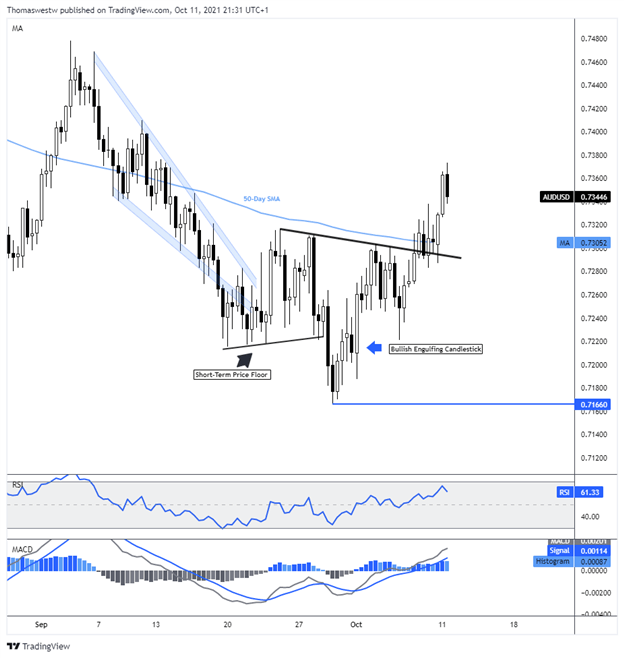

AUD/USD put in a solid move higher overnight, breaching above the 50-day Simple Moving Average (SMA). Upward momentum eased prior to hitting the psychologically important 0.74 handle, but bulls appear to be in control for the time being. If prices head lower, the 50-day SMA will come back into focus as potential support.

AUD/USD 8-Hour Chart

Chart created with TradingView

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter