New Zealand Dollar, NZD/USD, Building Permits, Covid, China PMI - Talking Points

- New Zealand Dollar softens versus USD as Covid risks weigh

- Chinese NBS PMI data likely to provide today’s event risk

- NZD/USD softens at resistance after last week’s rally

Tuesday’s Asia-Pacific Outlook

The New Zealand Dollar fell against the US Dollar overnight as traders attempt to balance risk drivers. Wall Street moved higher during New York’s Monday trading session, with growth-sensitive technology stocks leading the charge. Equity traders are pressing the buy button after Federal Reserve Chair Jerome Powell said the conditions for a rate hike are still a ways off.

Meanwhile, the situation around Covid continues to weigh on sentiment elsewhere in the markets. The Fed’s signaling makes for an attractive investment location as lockdowns across the Asia-Pacific region point to economic slowdowns. Australia’s New South Wales (NSW) reported a record increase in daily Covid cases on Monday for the prior 24 hours. The state, which includes Sydney, saw 1,290 locally acquired cases. Elsewhere, New Zealand added 52 active cases in the last 24 hours, according to the latest report from the Ministry of Health.

The United States is seeing its own concerns in rising Covid cases. The disparity in restrictions appears to be attracting capital flows into US markets. While Australia, New Zealand, and many Asian nations continue with a lockdown approach, the United States remains largely open for business. That, along with the Fed’s somewhat dovish outlook on rates, likely explains some upward momentum seen in equities, as well as the US Dollar’s tempered position near two-week lows.

Adding to the Covid woes lingering over traders’ heads is a move by the European Union to reimpose travel restrictions on the United States, according to an EU Council statement. The US is well above EU guidelines, which place a limit of 75 new virus cases per 100k people. Respective EU governments may or may not head the recommendations, although the move was enough to put pressure on airline stocks. Vaccinated people will likely be exempt from the restrictions.

New Zealand kicked off the economic docket for Tuesday. The island nation saw July building permits fall 2.1% on a month-over-month basis, down from June’s 4.0% figure. NZD/USD was unchanged on the report. Elsewhere, Japan will report unemployment and industrial production data. Australia will see inflation data from TD Securities/Melbourne Institute cross the wires.

China’s NBS manufacturing PMI figure for August is set to provide the main event risk today. Analysts expect the figure to drop at 50.2, slightly lower from the prior month’s 50.4 read. China, like other nations, is grappling with a growth slowdown. Steel output has fallen sharply due to government measures to cool off sky-high commodity prices earlier this year, but some are doubting whether those will last now that a slowing economy is pressuring policy makers’ resolve.

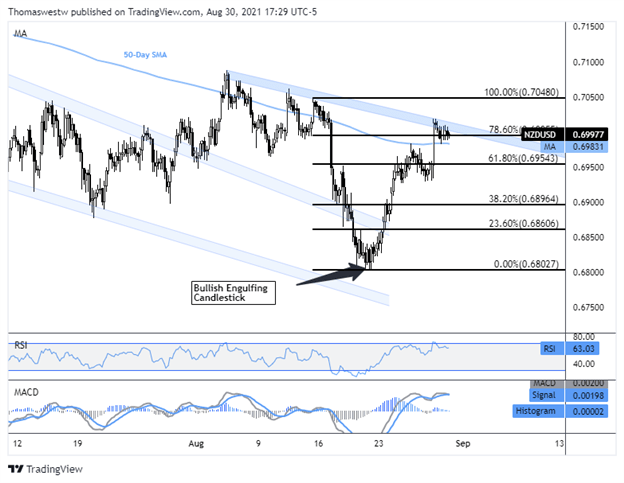

NZD/USD Technical Outlook:

The New Zealand Dollar shifted lower against the Greenback to start the week, with a descending trendline pinning prices after rallying last week. The currency pair held above the 50-day Simple Moving Average and the 78.6% Fibonacci retracement, which offers a bullish sign, however. Breaking above the trendline would likely open the door for more upside. Alternatively, breaking below the 50-day SMA and Fib level may lead to a retracement of last week’s bullish move.

NZD/USD Four-Hour Chart

Chart created with TradingView

New Zealand Dollar TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

- Subscribe to the DailyFX Newsletter for weekly market updates

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter