Australian Dollar, AUD/USD, Chinese Inflation, PPI, Covid, Rising Wedge - Talking Points

- Australian Dollar eyes Chinese CPI inflation, factory gate prices

- Rising Covid across Asia remains headwind for risk sentiment

- AUD/USD threatens to breakdown as it test wedge support

Monday’s Asia-Pacific Outlook

Asia-Pacific markets may open mixed today after last week’s non-farm payrolls (NFP) report lifted the US Dollar higher into the weekend as rate traders priced in accelerated Fed tightening. The stronger Greenback pushed the risk-sensitive Australian Dollar over half a percent lower on Friday, although the currency pair managed to hold onto a narrow weekly gain. Major equity indexes across the region also finished higher on the week.

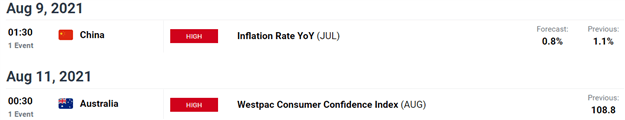

Chinese inflation data for July will likely provide today’s primary event risk for markets. Beijing has clamped down on rising prices through regulatory action over the past couple of months. Policy makers see high prices as a threat to the country’s economic stability. The consumer price index (CPI) is slated to cross the wires at 0.8% on a year-over-year basis, according to a Bloomberg survey of economists and analysts. That figure is 0.3% lower than in June.

Market participants will also digest China’s July factory gate prices via the producer price index (PPI). Economists expect the figure to show an 8.8% year-over-year increase, unchanged from the prior month. Producers in the region have been pressured by higher input costs from pandemic-induced supply bottlenecks and raw material shortages. Beijing would like to see inflation measures ease, which may reduce regulatory concerns. That said, avoiding hotter-than-expected CPI and PPI prints may allow some upside for Chinese markets.

Elsewhere, the 2021 Tokyo Olympics is officially over following the weekend’s closing ceremony. The massive sporting event challenged Japanese policymakers amid rising Covid cases. The Lambda Covid variant was identified in Japan for the first time last week. That strain was first detected in Peru and is thought to be possibly more infectious that what has been seen in other variants. Tokyo reported 4,066 new cases on Sunday as the country’s largest city remains under a state of emergency.

Australia is also facing higher case counts despite over half the country’s population being under lockdown. Australian officials have been scrambling to get more shots into arms, with not even 20% of the adult population being fully vaccinated. The state of Victoria started a 7-day snap lockdown on Thursday. In July, the Australian Dollar finished over 2% lower as traders attempted to price in Covid-related worries. Aussie Dollar traders will shift their focus to August’s Westpac consumer confidence index later this week. However, today’s inflation data out of China may have a material impact on the currency. As with Chinese markets themselves, AUD may see some upside if CPI registers weaker relative to forecasts.

Source: DailyFX Economic Calendar

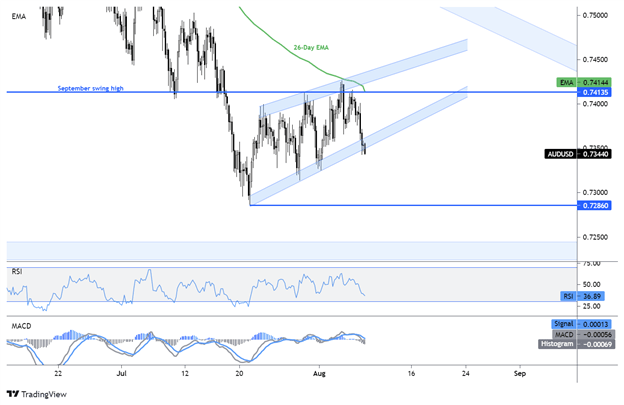

AUD/USD Technical Outlook:

AUD/USD is slightly lower in early Monday trade. A possible break below the lower bound of a Rising Wedge pattern may signal downtrend continuation.The pattern typically carries bearish implications. A MACD crossing below the indicator’s center line and a falling RSI hint that the the most likely outcome favors weakness.

AUD/USD 4-Hour Chart

Chart created with TradingView

Australian Dollar TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

- Subscribe to the DailyFX Newsletter for weekly market updates

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter