Australian Dollar, AUD/NZD, AUD/JPY, U.S. Stimulus, Sentiment - Talking Points

- Wall Street trading moved higher after U.S. Covid relief signed into law

- U.S. House of Representatives passes bill to raise stimulus checks to $2,000

- AUD/NZD, AUD/JPY higher, but thin holiday trading may be tempering gains

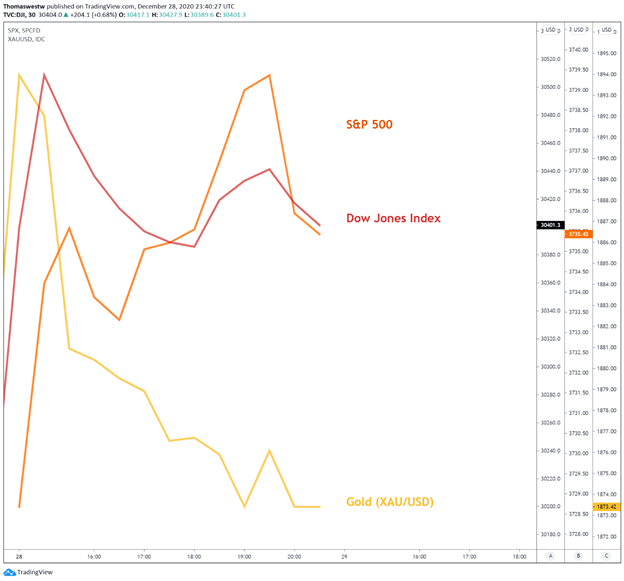

Wall Street traders pushed the Dow Jones, S&P 500, and Nasdaq Composite to fresh record highs on Monday following the extended U.S. holiday weekend. The risk-on mood was prompted by U.S. President Donald Trump’s signing of a $2.3 trillion government spending package which included $900 billion in Covid relief funds. This follows initial hesitation after asking Congress to amend the bill. The small-cap Russell 2000 was the only laggard, dropping 0.38%.

Monday’s upbeat sentiment reflected the continued economic support that comes with the Covid relief bill being signed into law. The measure includes extended enhanced unemployment benefits, $600 checks for many Americans, vaccine funding, and aid for small businesses. The bill’s passage cleared the waters a bit on the fragile economic outlook, hitting gold prices with XAU/USD dropping marginally, although silver prices moved higher.

The push for checks to be increased to $2,000 from $600 passed in a House vote late Monday. Now, the measure heads to the Senate where the bill’s fate is uncertain with many GOP lawmakers expressing worry over increasing government debt further amid the pandemic. The U.S. House of Representatives also secured enough votes to override Trump’s recent veto of the U.S. military spending budget, although the outcome is less likely to affect markets than the stimulus measure.

Dow Jones, S&P 500, Gold – 30-Min Chart

Chart created with TradingView

Tuesday’s Asia-Pacific Outlook

Wall Street’s upbeat sentiment is likely to carry over into the Asia Pacific session. A light economic calendar leaves risk appetite subject to the prevailing mood and American political headlines. The recent Brexit and vaccine developments are also likely continuing to underpin sentiment.

The fate of the upcoming U.S. Senate vote is uncertain, but sentiment is likely to be boosted further if passed, with President Trump already in support of increased payments. Nevertheless, Tuesday’s session will likely see light volumes regardless, with many traders out ahead of the New Year’s holiday. While this leaves many traders off the desk this week, the possibility for market moving events to manifest remains. After this week, traders may begin to eye any holiday related upticks in Covid cases across major economies.

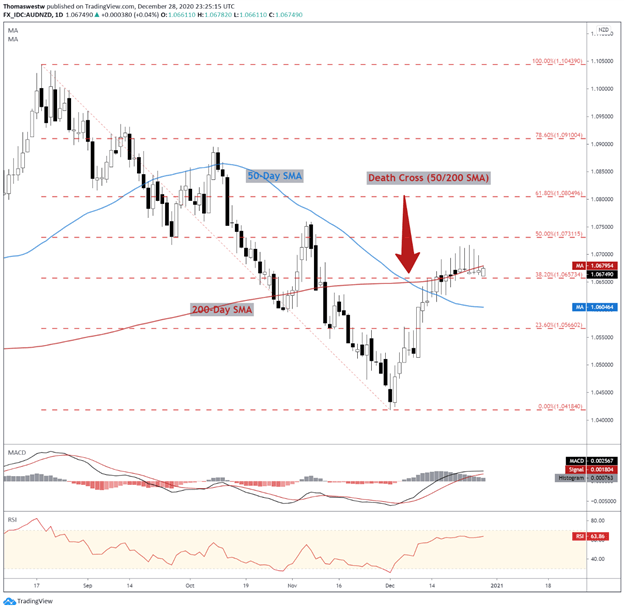

AUD/NZD Technical Outlook:

Meanwhile, the Australian Dollar is benefiting from the boost in sentiment as it makes gains against most of its major peers. AUD/NZD is finding support against its 38.2% Fib retracement from the Aug-Dec move. Still, steep rejections from intraday highs over the past week may be signaling some short-term exhaustion in bulls.

The 200-day Simple Moving Average (SMA) also appears to be exerting some pressure at current levels. Earlier this month, the 50- and 200-Day SMAs formed a bearish Death Cross that may be dragging on the pairs sentiment still. The upside will look for a breach above the 200-day SMA, and to the downside, a break below the 38.2% Fib.

AUD/NZD Daily Chart

Chart created with TradingView

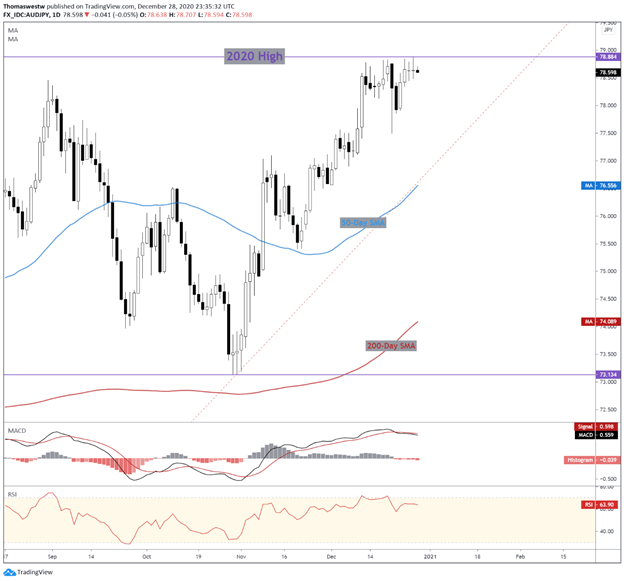

AUD/JPY Technical Outlook:

AUD/JPY is trading lower after setting a fresh yearly high on Monday. The overall direction appears poised for further upside, however, with the 50- and 200-day SMAs aiming firmly to the upside. A short-term pullback may manifest before breaking into new highs though, with the MACD recently breaking under the signal line, and RSI remaining in neutral territory.

AUD/JPY Daily Chart

Chart created with TradingView

AUD/NZD, AUD/JPY TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter