New Zealand Dollar, NZD/USD, Covid, UK Travel– Talking Points

- Wall Street trades lower as investors digest new Covid-related restrictions

- NZD/USD sees biggest daily loss since October as risk aversion rises

- Light economic data prints in the week ahead leave Covid in spotlight

Covid is back in the spotlight for traders after a new variant, one that is perhaps more contagious, was identified in the United Kingdom. Researchers are still analyzing the possible mutation, but preliminary estimates are showing it to be nearly 70% more transmissible. South Africa is also seeing a possible mutation of Covid, separate from the UK’s strain. The emergence has caused a flurry of new travel restrictions from both countries.

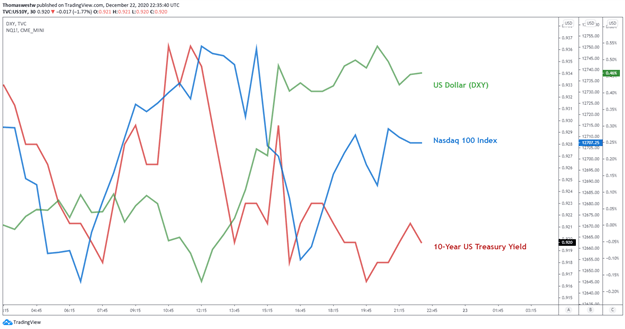

The US Dollar rose in reaction, while Treasury yields fell as investors shifted to the traditional safe-haven assets. Meanwhile, U.S. equities sold off on Wall Street during Tuesday’s session with the Dow Jones and S&P 500 dropping 0.67% and 0.21%, respectively. The 10-year Treasury yield fell to 0.92% while the US Dollar (DXY) climbed 0.63%. The Greenback is still near multi-month lows, however.

US Dollar, 10-Year Treasury Yield, Nasdaq 100 - Daily Chart

Chart created with TradingView

Wednesday’s Asia-Pacific Outlook

The New Zealand Dollar reflected the risk-off mood with NZD/USD dropping 0.80% on Tuesday as US Dollar inflows damaged recent gains in the pair. Still, the Kiwi remains higher versus the Greenback for December, but another day of weakness similar to Tuesday would bring NZD/USD to a negative stance for the month.

Given the lack of economic events on the docket, and combined with the Christmas holiday where many markets will be closed, risk trends will likely be dictated by the ongoing Covid situation, particularly the new strains in the UK and South Africa. However, France recently announced that it will re-open its border to essential travelers who have had a negative Covid test recently.

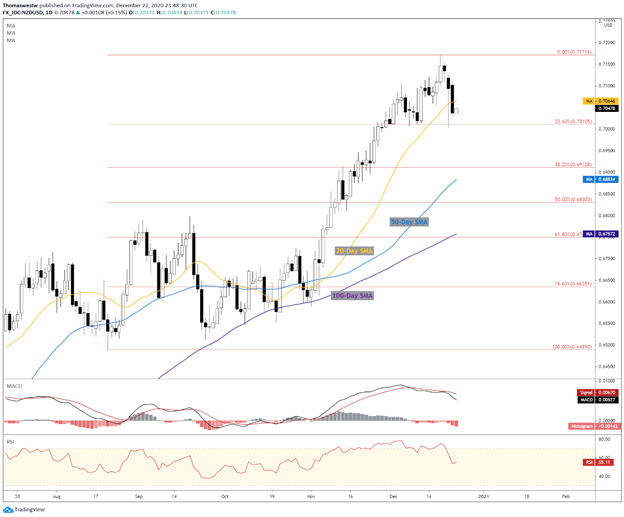

NZD/USD Technical Forecast:

NZD/USD’s recent weakness has dented some of the gains since October, but the overall bullishness likely remains intact above the 0.7000 psychological level. Bears scored a short-term victory by breaching the 20-day Simple Moving Average, but the longer-term 50-, 100-, and 200-day SMA’s still suggest that the broader trend remains biased higher.

The 23.6% Fibonacci retracement level from the August to December major move also appears to be offering recent support at 0.7010 which has stood several times this month. A break below would likely fuel bearish action. Coupled with a recent bearish MACD crossover, the 23.6% Fib retracement may likely be tested soon.

NZD/USD Daily Chart

Chart created with TradingView

NZD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter