BRITISH POUND, BREXIT, YEN, US DOLLAR - TALKING POINTS:

- British Pound pops higher as UK, EU extend Brexit negotiations

- Anti-risk US Dollar and Japanese Yen broadly lower vs. majors

- Pfizer/BioNTech Covid vaccine rollout, fiscal stimulus talks eyed

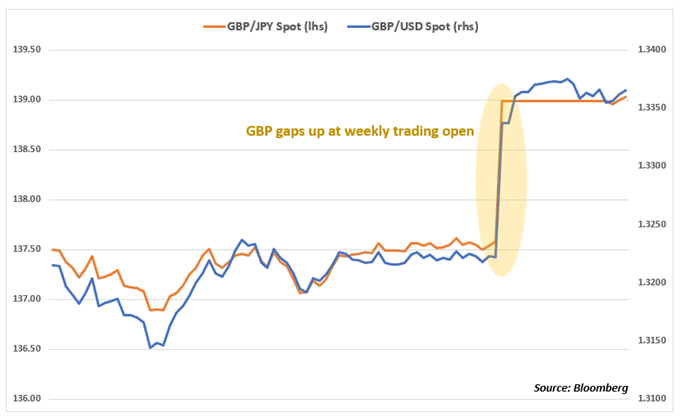

The British Pound is set to start the week on a high note after UK Prime Minister Boris Johnson and EU Commission President Ursula von der Leyen agreed to continue Brexit talks in hopes of scoring a last-minute deal. Negotiators were previously expected to abandon efforts at compromise if an accord could not be secured over the weekend as time runs out before the year-end deadline.

A joint statement from the two leaders said that despite the long road up to this point and the many obstacles that still remain, it is “responsible at this point to go the extra mile.” To that end, the two sides “mandated our negotiators to continue the talks and see whether an agreement can even at this late stage be reached.” The anti-risk Japanese Yen and US Dollar fell as the markets cheered the news.

Looking ahead, the economic calendar offers a relatively lackluster helping of scheduled event risk at the start of the trading week. The Bank of Japan will publish the fourth-quarter edition of the Tankan business confidence survey. Sentiment across large and small firms is expected to improve for a second consecutive period from Covid-inspired lows set in the second quarter, but remain in negative territory overall.

This probably leaves broader risk appetite trends to set the near-term course for financial markets. Besides Brexit, traders are likely to focus on the start of Covid vaccine deliveries in the US, where the Pfizer-BioNTech version is due to begin shipping on Monday. The fate of a bipartisan US$908 billion fiscal stimulus bill is also eyed. It is unclear so far if it has the votes needed to pass both chambers of Congress.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Ilya Spivak, Head APAC Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter