Vaccine Optimism, Australian Dollar, AUD/USD– Talking Points

- AUD/USD pushes higher as vaccine news underpins traders’ sentiment

- US Dollar struggles further as the vaccine-driven 2021 outlook strengthens

- Lack of economic data prints leave sentiment and technicals to drive price

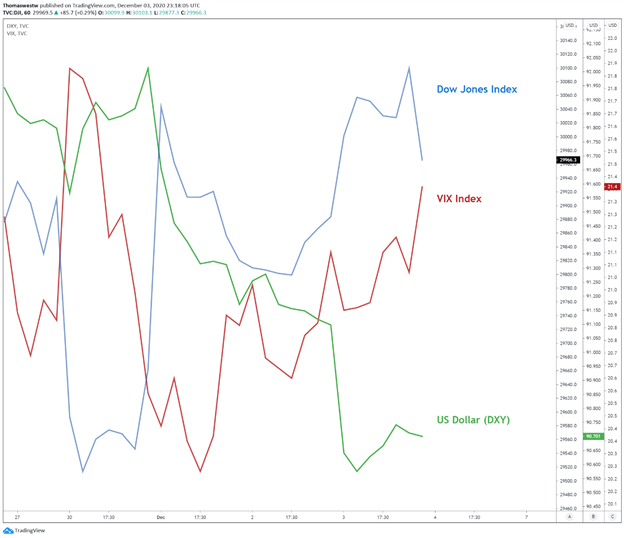

U.S. markets continued to enjoy a risk-on tilt Thursday as vaccine hopes boost economic prospects for 2021. The Dow Jones Industrial Average rose 0.29%, and the tech-heavy Nasdaq 100 managed to pull off a slight 0.09% gain. However, volatility did tick higher with the VIX index rising to its highest level since November 30 at 21.4.

The rise in volatility may hint that traders are starting to hedge equity positions. Thus, a near-term top may likely play out in U.S. equity indexes. The US Dollar’s (DXY) recent weakness accelerated, dropping under the 91 handle. Despite the rise in volatility, the Greenback’s decline is a reflection of growing global optimism around a strong economic recovery in 2021 as vaccine headlines continue to drop. In fact, the U.K. was the first western nation to announce the approval of a Covid-19 vaccine earlier this week.

Dow Jones, US Dollar, VIX Index – One Hour Chart

Chart created with TradingView

Friday’s Asia-Pacific Outlook:

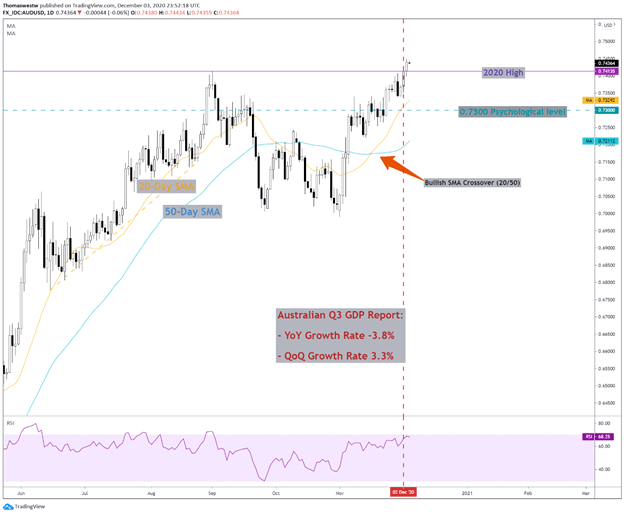

The Asia-Pacific session is on track to close out the first week of December on a solid bullish footing. The sentiment-linked Australian Dollar rose above its 2020 high earlier this week, bolstered by an upbeat GDP report. Today’s session will be lacking in major data prints according to the DailyFX Economic Calendar. Australia will release finalized retail sales for October. Later in the day, the Reserve Bank of India is set to release an interest rate decision. India's benchmark rate is expected to remain at 4% according to economists' forecasts.

The relatively quiet session will likely leave price action at the whim of market sentiment carried over from the U.S. session. Headline-related risks are possible on vaccine news, but technical levels are likely to drive trading. That said, AUD/USD may continue its push into higher territory. Current levels appear to be nearing overextended territory with RSI approaching 70. Still, the prevailing sentiment may see further upside movement. Any pullback may be short-lived. For now, the biggest risk would be a breakdown in global sentiment, but bulls may concede to a short pullback before moving higher.

AUD/USD Daily Chart

Chart created with TradingView

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter