JAPANESE YEN, US DOLLAR, PMI, FED, COVID-19 VACCINE - TALKING POINTS:

- Yen, US Dollar down as risk-on tilt prevails at the weekly trading open

- US Covid-19 vaccine hopes, firm Australian and New Zealand data eyed

- Soft European and US PMIs, ‘hands-off’ Fed tone may cool optimism

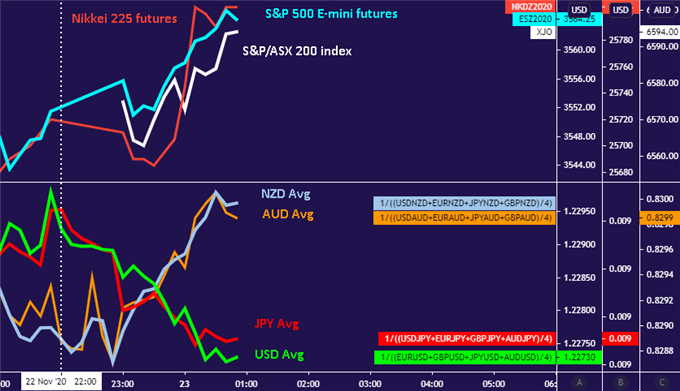

A broadly upbeat tone is prevailing in early Asia Pacific trade at the weekly open. The sentiment-geared Australian and New Zealand Dollars are tracking higher alongside stocks. At the opposite end of the G10 FX spectrum, the anti-risk Japanese Yen and US Dollar are facing selling pressure.

Firm economic data may account for some of investors’ chipper mood. New Zealand retail sales data sailed past forecasts to reveal a 28 percent surge in the third quarter. Separately, Markit PMI data showed Australian manufacturing- and service-sector activity growth accelerated to the fastest in three months.

Meanwhile, the news-wires were buzzing with supposed optimism about Covid-19 containment in the US. The head of the government’s efforts to accelerate vaccine development said over the weekend that inoculations will hopefully begin in less than three weeks.

Chart created with TradingView

The case for more of the same in the hours ahead seems suspect however. The preliminary set of November’s Markit PMI surveys for the Eurozone, the UK and the US headline the data docket. The recovery is expected to struggle across the board, with Europe seen suffering deep contractions.

Back-to-back speeches from Federal Reserve officials may likewise spook investors if they point to a central bank reluctant to expand the scope of stimulus. That might foreshadow disappointing guidance in FOMC meeting minutes due later in the week, pouring cold water on hopes for stimulus expansion.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Ilya Spivak, Head APAC Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter