AUD/USD, Moderna Vaccine, Covid – Talking Points

- Moderna vaccine news lifts sentiment, Wall Street stocks rise

- AUD/USD breaks above 0.73 handle, eyes 2020 high

- RBA minutes, Governor Lowe speech on tap

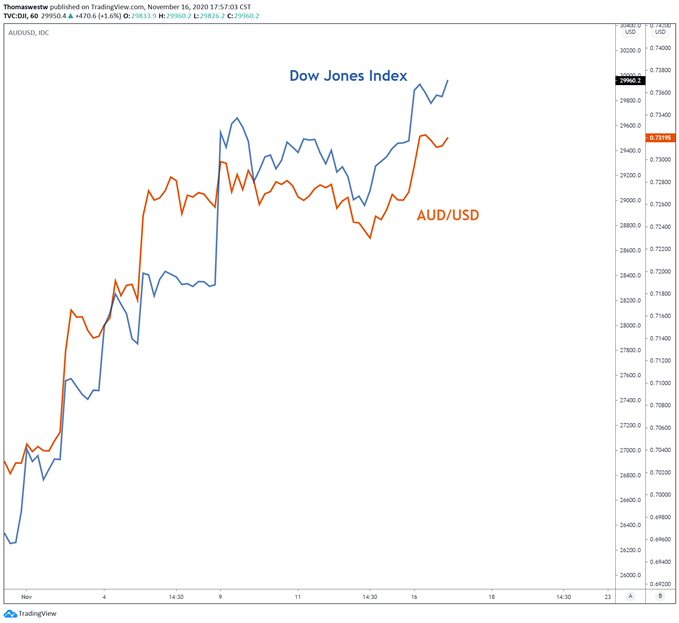

Australian Dollar strength is receiving a boost from further positive Covid vaccine news. The American-based biotechnology company Moderna announced results from its interim analysis showing a 94.5% efficacy rate. Wall Street stocks echoed the broader sentiment seen in the Aussie-Dollar as the Dow Jones index led the U.S. equity group with a 1.60% gain. The announcement from Moderna comes only a week after Pfizer’s report on its own positive vaccine results.

Industrial production data out of China likely also spurred some confidence in markets. China reported a 6.9% rise in output on a year-over-year basis, beating forecasts of 6.5%. Foreign direct investment surprised to the upside at the tune of 6.4% for October, also on a year-over-year basis. Retail sales came in weaker than expected but still grew from the previous month. Data from the world’s second-largest economy is a huge boon for confidence in the global economic recovery.

Dow Jones Index vs AUD/USD 1-Hour Chart

Chart created with TradingView

Tuesday’s Asia Pacific Outlook

Sentiment appears poised to spill over into the Asia Pacific trading session. New Zealand’s services sector expanded for October according to BusinessNZ. The PSI for October crossed the wires at 51.4, a one-point increase from the previous month. The data, combined with last week’s PMI, shows New Zealand’s economy on the path to recovery following the Covid pandemic.

The DailyFX Economic Calendar highlights upcoming unemployment data out of Hong Kong, and PPI figures from New Zealand. Later in the day, RBA Governor Philip Lowe will give a speech at the Australian’s Strategic Forum 2020. While not expected to be a large market-moving event, traders will be keen to listen for any actionable language on the path of easing from Lowe.

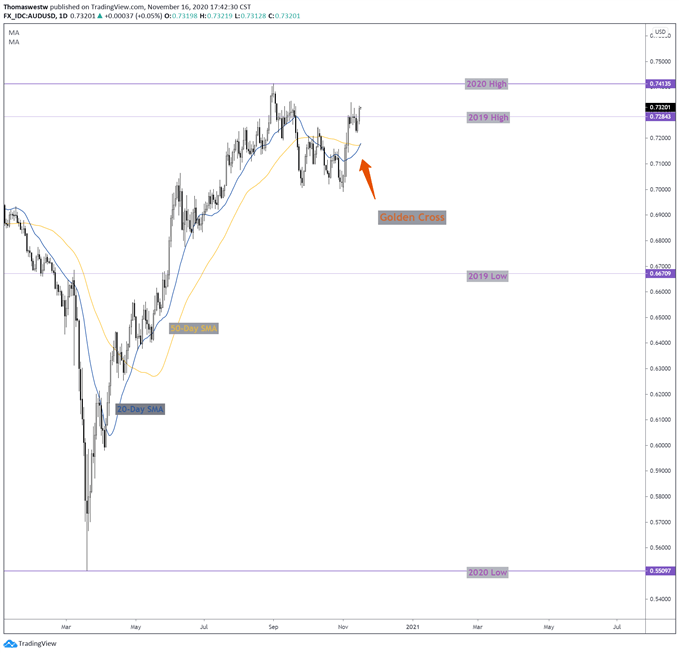

AUD/USD Daily Chart

Chart created with TradingView

The Australian Dollar is capitalizing on the uptick in market sentiment against the US Dollar. After Monday’s gain in the Aussie-Dollar, AUD/USD is now trading above its 2019 high once more. The 2020 high from early September serves as the level for price action to break before aiming for new peaks.

A recent cross in the pair’s moving averages may likely signal further upside momentum. The 20-day moving average has shifted above the 50-day one, this bullish signal is referred to as a Golden-Cross. AUD/USD is within 2% of the September high which gives a chance for new peaks to be taken, perhaps as soon as this week, should sentiment hold.

AUD/USD Trading Resources

•Just getting started? See our beginners’ guide for FX traders

•What is your trading personality? Take our quiz to find out

• Join a free webinar and have your trading questions answered

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter