2020 Election, Gold Price Analysis, 2020 Polls, Biden-Trump Spread - Talking Points

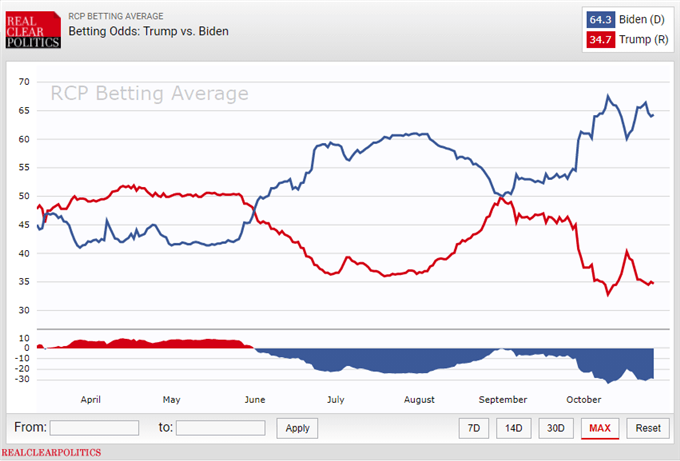

- Biden-Trump betting odds continue to show Biden way ahead of the incumbent

- Investors should not get complacent – there is precedent for an unexpected win

- Gold price decline may accelerate after XAU/USD broke a multi-week uptrend

6 DAYS UNTIL THE US PRESIDENTIAL ELECTION

It is less than a week to go until the US presidential election. Market volatility has been picking up, but that appears to be less the function of politically-related factors and more the jump in Covid-19 cases; more on that later. For now, betting odds and polling data from various agencies have Democratic nominee Joe Biden in the lead while incumbent President Donald Trump lags behind.

2020 US Election Polls

Having said that, investors should be careful not to get too comfortable with polling data after the 2016 election resulted in the unexpected victory of Mr. Trump. Mail-in votes have primarily come from Democrats, who as a group are more likely to cast the ballot this way than their Republican counterparts. This statistical phenomenon came from the findings of a poll conducted by NBCLX/YouGov.

As a result, it may give markets a false sense of certainty and could potentially set the actual voting day up for a significant period of volatility. Republicans will likely vote in person, which means that polls on election day may show a sharp rise in votes for Mr. Trump. That sudden burst may not necessarily indicate a victory for Mr. Trump, but premonitions about his chances could result in volatility and a stronger US Dollar.

Spiking Covid-19 Cases Undermining Precarious Growth Prospects

Covid-19 cases around the world and the epicenter of it all – the US – have been spiking in what appears to be the so-called “second wave” investors and policymakers have been dreading. France and the UK have imposed draconian lockdown measures that threaten to derail the already-fragile recovery, but public health may improve as a result.

In the US, from a market-oriented perspective, the prospect of re-imposed or extended lockdown orders without meaningful progress being made on fiscal talks, could spark a flight to havens. In this environment the US Dollar may rise – as it has over the past few days – particularly versus cycle-sensitive currencies like the Australian and New Zealand Dollars.

Gold Price Outlook

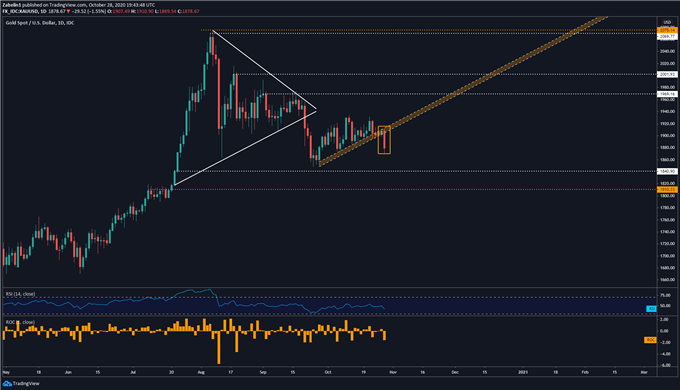

Gold prices have experienced their biggest one-day decline since October 6 and have also broken below a multi-week uptrend. The decisive invalidation of the slope of appreciation could signal the start of a deeper pullback as traders flock to the US Dollar and away from comparatively illiquid precious metals like gold.

Gold Price - Daily Chart

Gold Price chart created using TradingView

Sellers may encounter some friction at support at 1840.90 and could be where a recovery starts to take place if the pressure of buyers overwhelms the bears. Having said that, if sentiment increasingly turns sour, XAU/USD could puncture that floor too, potentially opening the door to testing the inflection point at 1810.33.

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter