2020 Election, AUD/USD Analysis, Election Polls, Biden-Trump Spread - Talking Points

- Joe Biden recently surged in 2020 election polling data following the first presidential debate

- Risk-oriented assets rising with political statistics despite bipartisan stalemate on fiscal talks

- AUD/USD bounce from 0.7018 setting pair up to challenge 0.7181 and 07206 resistance area

33 DAYS UNTIL THE US PRESIDENTIAL ELECTION

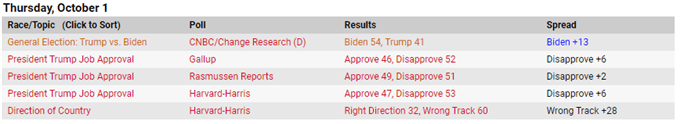

With almost exactly a month to go until voting day, polling data is showing former Vice President and Democratic nominee Joe Biden’s popularity gaining momentum. Meanwhile, the incumbent US President Donald Trump’s job approval of roughly 46-47 percent is adding to the widening gap of favorability between him and his opponent.

2020 US Election Polls

The first presidential debate may have played a role in this dynamic after post-debate polling stats showed overwhelming support for Mr. Biden. His popularity may have also grown as a result of his moderate answers to policies with wide-ranging implications – like the environment. His less-bold approach – relative to some colleagues in his party – gave markets a sigh of relief that his administration may not add to 2020’s volatility.

The vastly different approaches to legislation Mr. Biden and President Trump may have when it comes to trade, foreign policy and the like are what make this election so closely scrutinized. Therefore, because the binary outcome is so stark when it comes to policies and their impact on financial markets, investors are particularly on edge for this election.

With more polling data showing Mr. Biden in the lead, and due to the comparatively less uncertainty markets perceive him bringing relative to Trump, the statistics may be helping push risk-oriented assets higher. In this environment, equity indices may rise along with growth-anchored commodities like the New Zealand and Australian Dollars.

AUD/USD Price Analysis

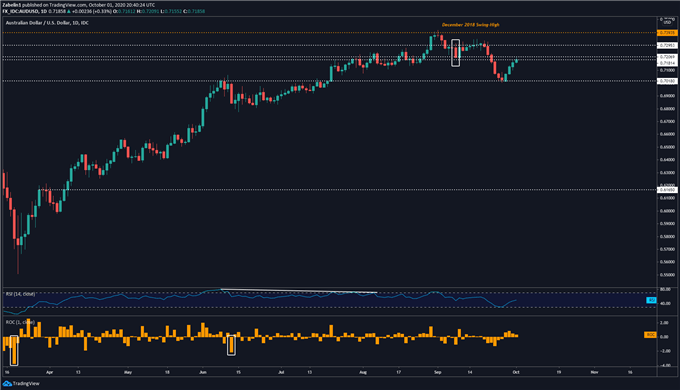

After spectacularly falling over five percent from the December 2018 swing-high at 0.7393, AUD/USD has started to recover. The pair found a floor to stand on at 0.7018 and is now challenging a key inflection range between 0.7181 and 07206. Clearing that zone could open the door to retesting resistance at 0.7295, though if the pair retreats it could broadcast an underlying lack of confidence in AUD/USD’s short-term outlook.

AUD/USD - Daily Chart

AUD/USD chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter