2020 Election, Nasdaq Analysis, Biden-Trump Election Odds - Talking Points

- Biden-Trump election betting averages continue to widen ahead of first presidential debate

- Technology stocks may rise again with demand for digital services as Covid-19 cases grow

- Nasdaq index recuperation may be in the works, recovery may encounter friction at 11263.6

42 DAYS UNTIL THE US PRESIDENTIAL ELECTION

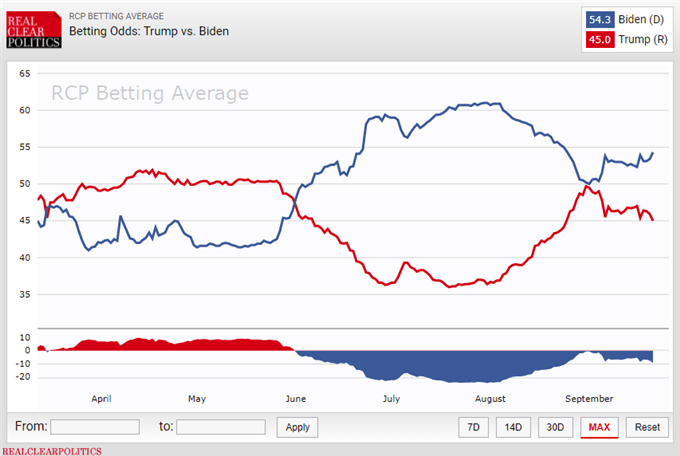

With less than a week until the first US presidential debate, former Vice President and Democratic nominee Joe Biden has successfully maintained a comfortable lead over President Donald Trump. RealClearPolitics’ betting averages for the election show the widest spread between the two candidates since mid-August as US coronavirus cases surge.

2020 US Election Polls

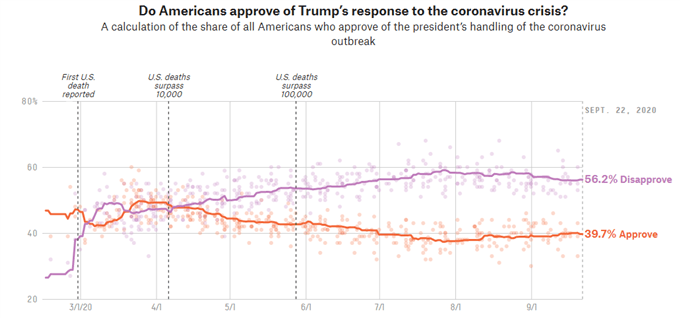

The US – after first originating in China, then spreading to Europe and ultimately North America – has been the viral hotbed of Covid-19. Confirmed cases of the coronavirus began to sharply rise in June. Perhaps not entirely by coincidence, polling data from FiveThirtyEight shows that around the same time, Trump’s approval rating for how he handled the coronavirus pandemic began to sharply decline.

2020 Poll on Trump

Consequently, if cases continue to grow – and the prospect of re-imposed or extended local lockdown orders increases – it could further dent Mr. Trump’s popularity and by default push Biden’s higher. These trends are particularly important to watch given the upcoming presidential debate on September 29. The Commission on Presidential Debates (CPD) has released what topics will be discussed.

US Coronavirus Cases Surge – Tech Stocks to Recover?

Following the collapse in equity markets in March by the virus-induced selloff, tech stocks rallied and outperformed other sectors. The likely catalyst was the premium put on digital services after shelter-in-place orders limited the number of outdoor activities. This may help explain why subscriptions for streaming services surged along with online shopping activity and helped push stocks like Amazon and Netflix higher.

If the spike in Covid-19 infections continues to persist, this dynamic may once again play out and help push tech stocks higher. While equity markets did recently pull back, indices like the S&P 500 and tech-leaning Nasdaq appear to show signs of bottoming out. However, given the fundamental circumstances, the recovery in equity markets may see the Nasdaq recover at a faster rate relative to its peers.

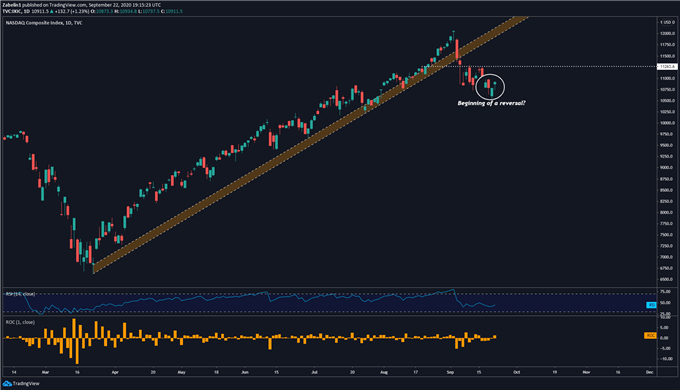

Nasdaq Outlook

The Nasdaq index may be in the early stages of a recovery as the tech-leaning benchmark jumps after bottoming out at a two-month low around 10599.00. The next obstacle to clear will likely be a familiar stalling point at 11263.6 where the index previously encountered friction along its ascent in mid-August and along its descent in early September.

Nasdaq Index - Daily Chart

Nasdaq chart created using TradingView

Clearing it 11263.6 with follow-through may invigorate traders and restore confidence in the Nasdaq’s potential. In that scenario, the critical barrier to clear will be the previous all-time high at 12074.1 the tech benchmark previously hovered before spectacularly crashing over 10 percent in less than a month.

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter