Talking Points: AUD/USD Analysis, Australian Dollar, US Dollar, Market Volatility, 2020 Election

- Market volatility pushinghaven-linked US Dollar higher, punishing cycle-sensitive FX

- Biden-Trump spread significantly widened with 2020 RCP’s betting averages diverging

- AUD/USD trading at critical chart support. What could it mean if pair break key range?

56 DAYS UNTIL THE US PRESIDENTIAL ELECTION

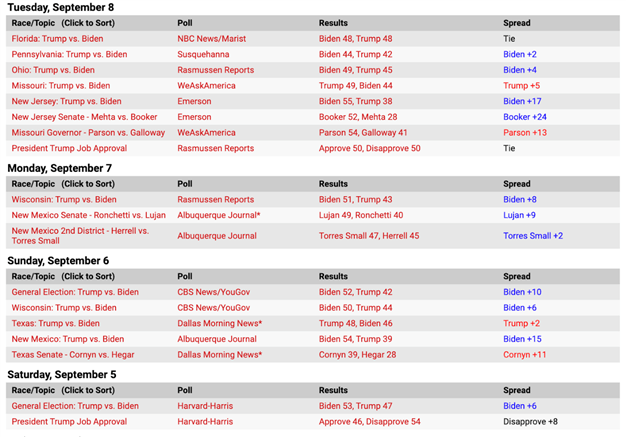

The 2020 US presidential election is less than two months away, with opinion polls to be released in the coming weeks seemingly growing in their potential for market impact. The latest figures show Democratic nominee and former Vice President Joe Biden with in the lead in the general election vs. President Donald Trump. Having said that, they are tied in Florida, a key swing state.

2020 US Election Polls

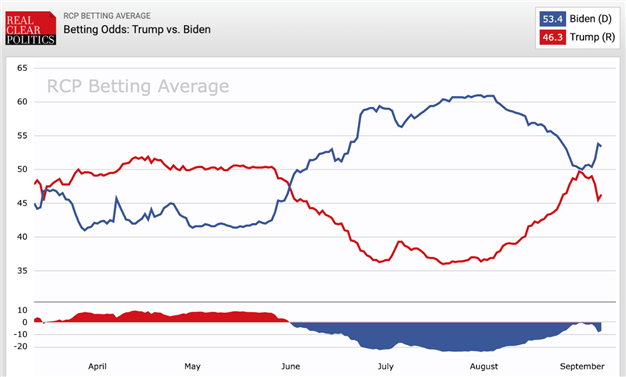

RealClearPolitics’ average of betting odds from online venues allowing speculators to wager on the election outcome have also significantly diverged after narrowing to their thinnest spread since the cross-over in June. While the impact implied in these considerations is unclear for now, as the presidential debate on September 29 comes closer, data of this nature may begin to stir markets.

Increasingly palpable election uncertainty could boost demand for havens like the US Dollar, which has staged a minor comeback in light of the recent bout of market volatility. Risk-oriented assets like the Australian Dollar have been hammered along with other commodity-linked currencies like the Norwegian Krone and New Zealand Dollar.

AUD/USD Analysis

After retreating from the December 2018 swing-high at 0.7393, AUD/USD is now trading on the cusp of a familiar and critical inflection range between 0.7206 and 0.7181. Looking ahead, if the pair cracks the lower layer with follow-through, this could be read as the beginning of a more serious retreat.

| Change in | Longs | Shorts | OI |

| Daily | -7% | 5% | -3% |

| Weekly | -23% | 50% | -8% |

AUD/USD - Daily Chart

AUD/USD chart created using TradingView

The buildup of risk aversion could amplify the pair’s losses if - to quote Noble prize-winning economist Robert Shiller - the “constellation of narratives” show a new bearish alignment. A contagion of growing fear about the pair’s trajectory could magnify this dynamic and cause AUD/USD to retreat further.

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter