Australian Dollar, AUD/NZD Outlook, Wall Street Trade, Coronavirus Vaccine, Australian Jobs Data – TALKING POINTS

- Australian Dollar may rise on strong risk appetite after upbeat day on Wall Street session

- Moderna vaccine deal with US pushed equities higher. Tech reclaimed some lost ground

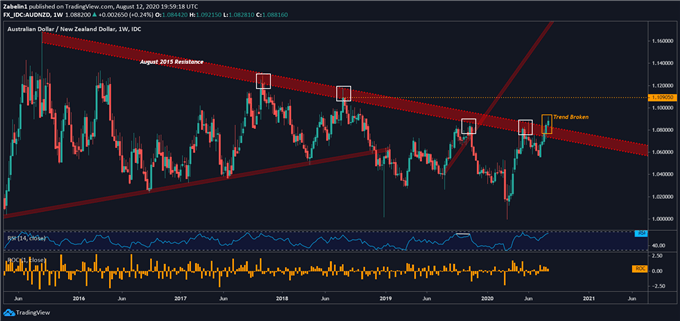

- AUD/NZD reaching beyond five-year ceiling, gains may be curbed ahead of key resistance

Equity markets surged on Wednesday with the Dow Jones, S&P 500 and Nasdaq indies closing 1.23, 1.60 and 2.28 percent higher, respectively. The information technology categories in the former two benchmarks led with gains and helped pushed the tech-dominated Nasdaq higher, crowning it Wall Street trade’s champion. Market optimism also saw spreads on credit default swaps of corporate debt across the risk spectrum narrow.

The S&P 500 briefly surpassed its February peak before the selloff in March, marking an over 50 percent rise in less than 7 months, before closing just shy of it. Tesla shares spiked at open after the company announced a five-for-one stock split, closing at over $1,500 per share. Index heavy-weights like Apple (APPL) and Amazon (AMZN) recovered and helped lift the benchmarks that they are cataloged under.

Equity markets appeared to also rally after news crossed the wires that American biotechnology company Moderna has reached a deal with the US to produce 100 million doses of coronavirus vaccine. The news was announced by US President Donald Trump after markets had closed on Tuesday evening. The news subsequently catapulted equity markets the following day.

Their rise came at the expense of the haven-linked US Dollar which had benefited from souring sentiment the preceding two days. The cycle-sensitive Australian and New Zealand Dollars were down, with the latter still reeling from the RBNZ rate decision. The British Pound also suffered and was arguably the session’s biggest loser in the aftermath of preliminary Q2 GDP data showing a jaw-dropping figure.

Thursday’s Asia-Pacific Trading Session

Asia-Pacific equity markets may rise as part of a sentimental echo effect after Wall Street trade. Consequently, USD and JPY may extend their losses but help stifle the fall in NZD and potentially push AUD higher. The latter will be thrust into the spotlight ahead of local jobs data. Analysts are estimating a 30.0k employment change for July, a 7.8% unemployment rate and a slightly higher participation rate at 64.4%.

AUD/NZD Analysis

AUD/NZD has broken above a five-year descending resistance channel with an eye at the June 2018 swing-high at 1.1090. The pair’s rise can be in part attributed to RBNZ policies and forecasts – like the one we saw on Wednesday – that weakened the New Zealand Dollar. Having said that, the pair may trim some of its recent gains if Australian employment data cause RBA easing expectations to swell and subsequently punish AUD.

AUD/NZD – Weekly Chart

AUD/NZD chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter