Japanese Yen, Geopolitical Risks, US-China Tension, Bank of Japan Rate Decision – TALKING POINTS

- Japanese Yen may rise on US-China geopolitical tension, Bank of Japan rate decision

- Tension over Hong Kong driving a cross-Pacific wedge, putting AUD and NZD at risk

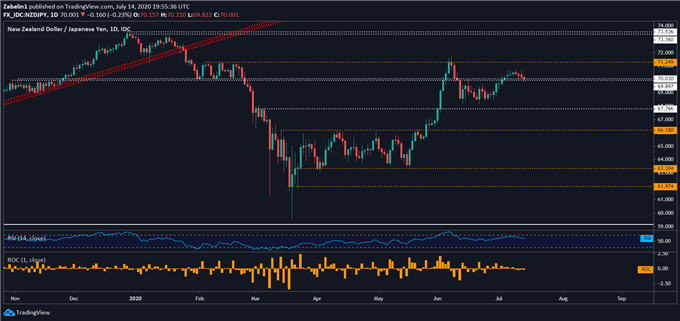

- NZD/JPY may retreat below key inflection range after rejection at a multi-week ceiling

Wall Street stocks ended on an upbeat note with the Dow Jones, S&P 500 and Nasdaq indices closing 2.13, 1.34 and 0.94 percent higher, respectively. In the S&P, energy was the best-performing sector, specifically the Oil & Gas Equipment & Services sub-component. Not entirely by coincidence, Brent was up 0.80 percent for the day along with the petroleum-linked Norwegian Krone and Swedish Krona.

Foreign exchange markets were somewhat of a mixed bag with the Canadian, New Zealand and Hong Kong Dollar as the session’s biggest losers. The US Dollar, Japanese Yen and Swiss Franc were mixed while the Euro was mostly in the green. The latter’s strength appears to be in anticipation of hopeful news ahead of the ECB rate decision and key EU summit later this week.

Read more about how Euro traders are betting on the smooth passage of a EUR750b aid package here.

Risk appetite was buoyed after investment bank giant JPMorgan reported record-breaking trading revenue despite worst recession since 1930’s. This put the haven-linked US Dollar on the defensive and further amplified EUR/USD’s gains. The spread of credit default swaps on sub-investment grade corporate debt slightly narrowed, further underscoring what appeared to be a buoyant session.

After markets closed, US President Donald Trump gave a press briefing on Chinese-related policies. He said the US is ending its preferential treatment for Hong Kong and will no longer export sensitive technologies. He added that if countries want to do business with the US, they cannot work with the Asian tech giant Huawei. Other comments included holding China accountable for the virus and “unleashing” it upon the world.

Wednesday’s Asia-Pacific Trading Session

Market sentiment appears to be aggressively risk-on despite the President’s comments and the possibility of retaliation by Beijing. Crude oil and a slew of other growth-oriented assets like copper, AUD, NZD and emerging-market FX may initially rally at the expense of the US Dollar and Japanese Yen.

JPY will later be thrown into the spotlight ahead of the Bank of Japan rate decision. Markets are not anticipating for officials to change the benchmark interest rate at -0.1%. However, gloomy commentary in the central bank’s Quarterly Outlook Report could put a premium on the Yen and a discount on risk-oriented assets like AUD and NZD.

NZD/JPY Analysis

NZD/JPY is trading on the cusp of a narrow but critical inflection range between 69.897 and 70.000 that has been in play since November 2019. If the pair bounces, its gains may be capped at 71.249 where the pair just back in late May had flirted with extending its over 11-percent rally that same month. This could subsequently lead to a congestive interim and reinforce underlying uncertainty in NZD/JPY’s trajectory.

NZD/JPY – Daily Chart

NZD/JPY chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri Twitter