Australian Dollar, AUD/USD Analysis, Coronavirus, RBA – TALKING POINTS

- Wall Street equity markets rallied despite a growing number of coronavirus cases

- Australian Dollar may gain on RBA rate decision if outlook points to stabilization

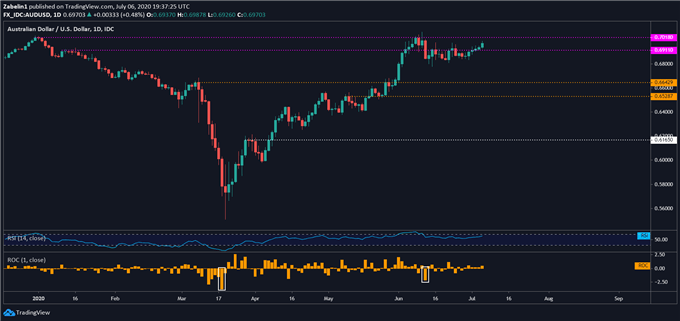

- AUD/USD punctured 0.6911, but early-January resistance above it may cap gains

Wall Street equity markets ended the day with the Dow Jones, S&P 500 and Nasdaq indices closing 1.78, 1.59 and 2.21 percent higher, respectively. The S&P 500 benchmark’s gains were supercharged by the consumer discretionary subcomponent, specifically by internet and direct marketing retail stocks. These included Amazon, (AMZN), Booking Holdings Inc (BKNG), eBay (EBAY), and Expedia Group Inc (EXPE).

The risk-on tilt in market mood punished the haven-linked US Dollar and anti-risk Japanese Yen, while the cycle-sensitive Swedish Krona and Norwegian Krone prospered. The Australian and New Zealand Dollars were mixed, while the Canadian Dollar and politically-sensitive British Pound ended the day in a sea of red. Optimism about economic stabilization permeated asset classes despite a rising number of coronavirus cases.

Tuesday’s Asia-Pacific Trading Session

Risk appetite may echo into Asia-Pacific markets and push APAC stocks higher at the expense of anti-risk assets like JPY and USD. The RBA rate decision will be the session’s biggest event risk, placing the Australian Dollar in the spotlight. Officials are not expected to change the Overnight Cash Rate (OCR), but commentary from monetary authorities on signs of economic stabilization may inspire a rally in the Australian Dollar.

Be sure to follow me on Twitter @ZabelinDimitri for market-moving updates

AUD/USD Analysis

After timidly trading below the second tier of the 0.7018-0.6911 range, AUD/USD appears to be lacing up its bootstraps as it scales a mountain it previously fell off of in early June. Failure to break above the early-January swing-high for a second time could catalyze an aggressive selloff if capitulation broadcasts an underlying lack of confidence in the pair’s upside potential in the near term.

AUD/USD – Daily Chart

AUD/USD chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri Twitter