Australian Dollar, Japanese Yen, Chinese PMI Data, Coronavirus – TALKING POINTS

- Stocks jumped on housing data and a key announcement from Boeing

- Australian Dollar cautiously eyes critical Chinese PMI data for June

- AUD/JPY cleared descending ceiling – is a bullish spike in the cards?

Wall Street trade ended on a rosy note, with the Dow Jones, S&P 500 and Nasdaq indices closing 2.32, 1.47 and 1.20 percent higher, respectively. Industrials was the leading sector in the Dow Jones, rising 6.59 percent for the day, specifically led by Aerospace and Defense. This spike came from Boeing receiving news from the Federal Aviation Administration that it was allowed to start testing flight of the 737 MAX aircraft.

US housing data also buttressed risk appetite after pending home sales on a month-on-month basis surged 44.3 percent, the highest figure ever recorded. Considering the implications of housing data for consumer confidence and economic growth, these staggering statistics appeared to play a key role in driving sentiment. To learn more about key indicators to monitor, be sure to follow me on Twitter @ZabelinDimitri.

Foreign exchange markets, however, were somewhat of a mixed bag. The anti-risk Japanese Yen and Swiss Franc fell along with the Brexit-sensitive British Pound. The Australian and New Zealand Dollars were mixed, though the Danish Krone and petroleum-linked Norwegian Krone ended the day mostly higher. Crude oil along with a number of hard and soft commodities almost all ended the day in the green.

Tuesday’s Asia-Pacific Trading Session

Asia-Pacific stock markets and US equity futures may modestly climb into Asia, with foreign exchange markets – particularly the China-sensitive AUD and NZD – focusing on Chinese PMI data for June. An uptick here could amplify market optimism as investors oscillate between panic and indifference about the growing number of Covid-19 cases.

Australian Dollar Technical Analysis

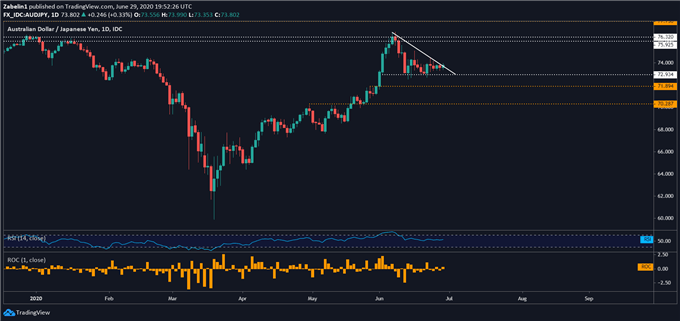

AUD/JPY broke just a hair above descending resistance that was formed at the multi-month swing-high at 76.220 where the pair stalled before turning lower. Invalidating the slope of depreciation after breaking out of the compression zone could signal the start of another bullish spike. Having said that, AUD/JPY’s gains could be curbed if the ceiling that stifled its rise last time holds.

AUD/JPY – Daily Chart

AUD/JPY chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri Twitter