Canadian Dollar, USD/CAD, Wall Street, US Dollar, Australian Dollar – Asia Pacific Market Open

- Canadian Dollar gains despite weakness in crude oil, Wall Street soars

- Markets welcomed Chinese export surge, BoE and upcoming trade talks

- Nikkei 225, ASX 200 may rise, perhaps boosting the sentiment-linked AUD

Canadian Dollar Gains as Wall Street Rallies in Broad “Risk-On” Thursday

The growth-linked Canadian Dollar experienced a relatively rosy session on Thursday despite weakness in crude oil prices. The commodity is a key source of revenue in Canada and can often inspire the trajectory of monetary policy from the BoC. Rather, USD/CAD seemed to be glued to sentiment which was broadly optimistic, denting demand for the haven-linked US Dollar and similarly-behaving Japanese Yen.

The S&P 500 and Nasdaq Composite closed +1.15% and +1.41% respectively in a day that saw market optimism gradually improve over the course of 24 hours. It began during the Asia Pacific trading session as China saw exports unexpectedly surge, resulting in a US$45.34 billion trade surplus. Then the Bank of England left rates unchanged as a couple of policymakers voted to raise the amount of QE asset purchases.

Develop the discipline and objectivity you need to improve your approach to trading consistently

The sentiment-linked Australian and New Zealand Dollars outperformed as stocks rallied. Traders may have also welcomed reports that US and Chinese trade officials are planning a phone call as soon as next week. Lately, fears of trade war escalation have been fueling additional uncertainty about global growth. Investors may have interpreted their plan as a signal that the two sides could help alleviate tensions.

Friday’s Asia Pacific Trading Session

Futures tracking the major benchmark stock indexes on Wall Street are pointing cautiously higher heading into Friday’s Asia Pacific trading session. That may open the door for regional indexes – such as the Nikkei 225 and ASX 200 – to push higher. Such as ‘risk-on’ narrative may bode well for the Australian Dollar while risking sapping the appeal of the US Dollar and Japanese Yen.

Canadian Dollar Technical Analysis

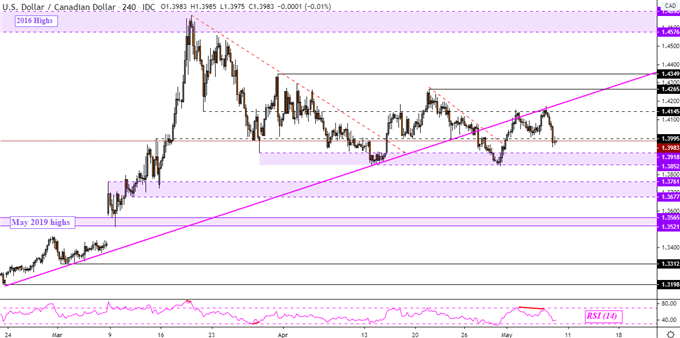

The USD/CAD has extended losses ever since prices stalled under former rising support which acted as new resistance earlier this week – as expected. This has opened the door for the Canadian Dollar to strengthen and perhaps retest critical support which appears to sit between 1.3852 to 1.3918. The pair has generally been consolidating since late March and a descent through that area opens the door for downtrend resumption.

| Change in | Longs | Shorts | OI |

| Daily | -12% | -7% | -9% |

| Weekly | 27% | -12% | -2% |

USD/CAD – 4-Hour Chart

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter