Canadian Dollar, Crude Oil, S&P 500, Coronavirus – Asia Pacific Market Open

- Canadian Dollar trims losses as crude oil prices soar, USD/CAD stalling?

- Stocks rally as California eyes reopening, Treasury sees record borrowing

- Australian Dollar facing the RBA next, may focus on sentiment afterwards

Canadian Dollar Trims Losses as Crude Oil Prices Soar and Sentiment Rebounds

The Canadian Dollar trimmed losses as crude oil prices soared and sentiment rebounded on Monday. Risk aversion was on the menu during earlier in the session as US-China trade war fears resurfaced. President Donald Trump has been hinting at retaliation, in the form of tariffs, against China for their handling of the coronavirus. The haven-linked US Dollar and similarly-behaving Japanese Yen ended the day slightly higher.

As the Wall Street session wrapped up, the S&P 500 and tech-heavy Nasdaq Composite closed +0.53% and +1.23% respectively. Sentiment was bolstered after California virus fatalities rose by the fewest in 3 weeks as Governor Gavin Newsom signaled that some businesses may reopen at the end of this week. Likely compounding market optimism was the US Treasury announcing it will borrow a record $3 trillion in Q2.

Prospects that more nations around the world are heading towards loosening lockdown measures, opening the door to greater business activity, may have bolstered growth-linked crude oil prices. Energy stocks were the best-performing sector in the S&P 500 followed by tech stocks. The sentiment-linked Australian Dollar aimed slightly higher, trimming aggressive losses over the past couple of trading sessions.

What are some unique aspects of trading forex?

Tuesday’s Asia Pacific Trading Session

Top-tier economic event risk during Tuesday’s Asia Pacific trading session is the RBA rate decision. Australia’s central bank is not expected to adjust its benchmark lending rate which sits at 0.25%. So AUD/USD may focus on policymakers’ assessments of growth, employment and inflation.

While there could be some near term volatility due for the growth-oriented Aussie, its broader trajectory may rather focus on market mood. Regional bourses may follow Wall Street higher, but the risk remains in the background that US-China tensions could heat up amid a pandemic taking its toll on the global economy.

Canadian Dollar Technical Analysis

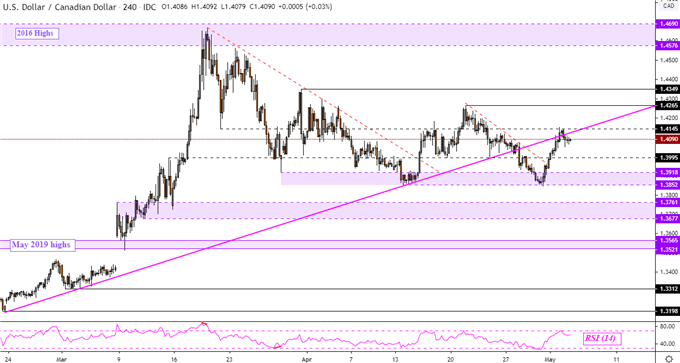

USD/CAD stalled after prices bounced off April lows. The latter make for a range of support between 1.3852 to 1.3918. The rising trend line from February – pink line on the chart below – seems to be working in conjunction with what has been acting as an inflection point around 1.4145 since mid-March. A turn lower from here places the focus on 1.3995 on the way back to 1.3918. A push above 1.4145 exposes 1.4265.

| Change in | Longs | Shorts | OI |

| Daily | -13% | 14% | 1% |

| Weekly | 39% | -15% | 1% |

USD/CAD – 4-Hour Chart

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

https://www.tradingview.com/symbols/USDCAD/?exchange=FX_IDC