Australian Dollar, New Zealand Dollar, US Dollar, Japanese Yen – Asia Pacific Market Open

- Australian Dollar may confirm downside breakout, risking more losses

- European shares fell most on record, Wall Street down most since 1987

- U.S. fiscal relief may be delayed until Monday, risking further volatility

Thursday’s Wall Street Session Recap

The sentiment-linked Australian Dollar and similarly-behaving New Zealand Dollar fell as the haven-linked US Dollar and anti-risk Japanese Yen soared. The Euro Stoxx 50 tumbled 12.40% in a single session, the most on record. On Wall Street, the Dow Jones and S&P 500 plummeted -9.99% and -9.51% respectively. This was last matched in 1987 on October’s “Black Monday” almost 33 years ago.

Equities continued their rout amid the coronavirus outbreak that has been reshaping economic forecasts around the world. Global growth is increasingly at risk, with fears of a recession inching closer towards reality. During a prime-time address to the nation in Asia Pacific trading hours, U.S. President Donald Trump struggled to alleviate panic as local futures markets tumbled into the North American trading session.

The markets were likely looking for expediency on a fiscal response with worldwide monetary policy seemingly close to its limits already. The European Central Bank and Federal Reserve dialed up liquidity-boosting efforts today, temporarily causing a bounce in equities. That proved to be short-lived however as selling pressure resumed and Wall Street brought the 11-year “bull market” to an end.

Below are key developments that occurred over the past 24 hours amid the coronavirus outbreak:

- The MSCI All-Country Index entered a bear market

- Iran asked the International Monetary Fund (IMF) for $5b to help with coronavirus

- The Bank of Japan is reportedly readying to strengthen stimulus efforts in the week ahead

- India’s Nifty 50 entered a bear market

- The Singapore government planned a second virus stimulus package

- The Mexican Peso fell to a record low against the US Dollar

- The ECB left rates unchanged, boosted quantitative easing and liquidity tools

- ECB President Christine Lagarde said ambitious, coordinated virus response is required

- Italian coronavirus deaths topped 1k

- U.S. investment-grade bond funds saw a record outflow of $7.3b

- Wall Street plunged in worst single-day drop since 1987, almost 33 years ago

- Euro Stoxx 50 dropped 12.40% in worst day on record

Friday’s Asia Pacific Trading Session

Sentiment is likely to remain the focal point in foreign exchange markets given a rather sparse economic docket during Friday’s Asia Pacific session. All eyes are on what the US fiscal response will be to the vpandemic. The House of Representatives is reportedly preparing to vote on a bi-partisan relief package before the day’s end. However, President Donald Trump said earlier today that he does not support the bill.

Potentially more worryingly, there are unconfirmed reports that the Senate has closed up shop for the week. However, it will be back in session come Monday with an originally-planned recess now put off to help with combating the coronavirus. If this is the case and the House passes a relief bill tonight, its implementation may have to wait until next week, risking further market volatility. That may leave AUD/USD at risk.

Australian Dollar Technical Analysis

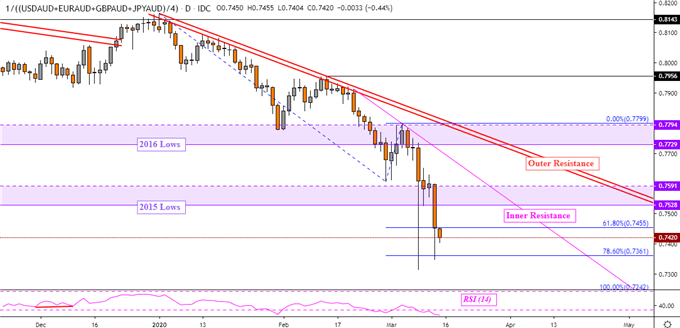

My majors-based Australian Dollar index may be on the verge of confirming a downside breakout through 2015 lows. The index averages AUD against USD, EUR, GBP and JPY. If there is follow-through, on average the Aussie could be looking to aim for its cheapest point since 2009. Maintaining declines are points of inner and outer resistance on the daily chart below.

| Change in | Longs | Shorts | OI |

| Daily | -3% | -8% | -4% |

| Weekly | 7% | -9% | 4% |

Majors-Based Australian Dollar Index Daily Chart

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter