Japanese Yen, US Dollar, Gold, S&P 500, Fed – Asia Pacific Market Open

- Anti-risk Japanese Yen gains as Federal Reserve fuels “risk-off” trade

- S&P 500 and US Dollar drop, anti-fiat gold prices rally with Treasuries

- Asia Pacific stocks may fall, sending the pro-risk Australian Dollar lower

Japanese Yen Gains as US Dollar Falls on Federal Reserve Rate Decision

The anti-risk Japanese Yen was the best-performing major currency on Wednesday as equities cautiously declined after the Federal Reserve left rates unchanged as expected. The reaction in markets was an almost textbook response to what appeared to be interpreted as a more-dovish shift. In addition to one cut being fully priced in, overnight index swaps are now baking in about a 64% chance of a second reduction by year-end.

US government bond yields declined across the board to reflect this prospect. This is as the US Dollar weakened due to its relatively high yield being put at risk. The combination of these two helped push anti-fiat gold prices to the upside. Yet anticipation of looser credit conditions did not translate into broader gains in the S&P 500 on Wall Street. The pro-risk Australian and New Zealand Dollar slightly fell.

Fed Chair Jerome Powell said that uncertainties to the outlook remain. The central bank also announced that it will extend repo operations at least through April. However, the Fed expects to adjust the size and pricing of these and eventually slow the pace of purchases over time. That may have contributed to jitters in equities which have been benefiting from a swell in the central bank’s balance sheet – as expected.

Thursday’s Asia Pacific Trading Session – Australian Dollar, Japanese Yen

With that in mind, Asia Pacific benchmark stock indexes may follow the cautious tone on Wall Street. A closely-watched segment of the U.S. yield curve is fast approaching inverted territory once more and may bring back concerns about economic health. This is as China reported that total coronavirus cases surged to 7,711 according to the National Health Commission. A “risk-off” tone ahead may sink the sentiment-linked AUD while boosting the anti-risk JPY.

Japanese Yen Technical Analysis

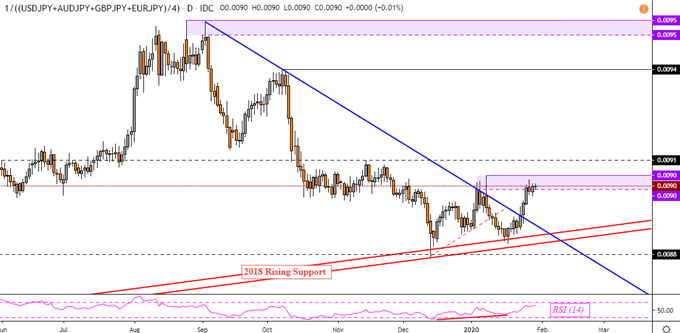

My majors-based Japanese Yen index is still on the verge of attempting to reverse the dominant downtrend from September. Prices have taken out the key falling trend line, though are stuck at the psychological barrier consisting of highs from earlier this month. This is a market positioning hints at what could be near-term Yen strength against currencies such as the Australian Dollar and Euro at the time of this writing.

Majors-Based Japanese Yen Index

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter