Asia Pacific Market Open Talking Points

- GBP/USD and EUR/USD declined on softer European PMI surveys

- US Dollar capitalized, also gaining on stronger local economic data

- Hong Kong Bill may fuel volatility, Japanese Yen could appreciate

Find out what the #1 mistake that traders make is and how you can fix it!

British Pound and Euro Declined Against the US Dollar

The British Pound was the worst-performing major currency on Friday, sinking as worse-than-expected UK economic data crossed the wires. Markit manufacturing PMI clocked in at 48.3 versus 48.9 anticipated, showing a larger-than-expected contraction in industrial activity. The Euro also came under selling pressure in the aftermath of similar measurements on the service-side of German, French and Eurozone statistics.

Weakness in major European currencies ended up supporting the US Dollar as government bond yields in the United Kingdom and Germany declined. During the Wall Street session, higher-than-expected US Markit manufacturing PMI added fuel to the Greenback’s ascent. The survey printed at 52.2 for preliminary November readings, up from 51.3 in October. An outcome greater than 50 indicates expansion in activity.

Fading 2020 Fed rate cut bets were brushed aside by the S&P 500 as the focus for medium-term price action remained on US-China trade war news. Stocks closed higher in the aftermath of commentary from President Donald Trump who said that a China trade deal was “very close”. The latter wants to see the US begin unwinding tariffs imposed against it.

Monday’s Asia Pacific Trading Session

A lack of major economic event risk greets the start of Monday’s Asia Pacific trading session. That places the focus for currencies on market mood. Lately, a fundamental story that has major implications for US-China trade talks is the Hong Kong Human Rights and Democracy Act. This bill was passed with a supposed veto-proof majority in Congress.

China has expressed its displeasure with the measurement and a consequence of this bill coming into could be economic countermeasures. This could come in the form of tariffs against the US, potentially derailing trade talks. Such an outcome risks denting market mood, fueling the anti-risk Japanese Yen at the expense of the sentiment-linked Australian and New Zealand Dollars.

Euro Technical Analysis

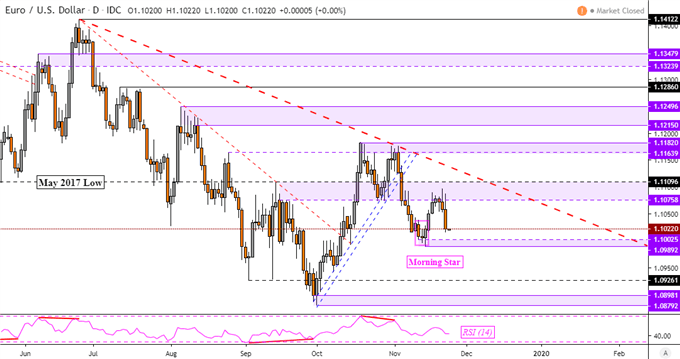

EUR/USD turned sharply lower on Friday as prices failed to breach the key psychological barrier between 1.1075 and 1.1109. This leaves the Euro facing towards near-term support which is a narrow range between 1.0989 and 1.1002. A daily close under this area could resume the near-term downtrend from the beginning of this month, overturning the Morning Star bullish candlestick pattern.

Chart of the Day – EUR/USD

Chart Created Using TradingView

FX Trading Resources

- See how the Euro is viewed by the trading community at the DailyFX Sentiment Page

- See our free guide to learn what are the long-term forces driving the US Dollar

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter