Asia Pacific Market Open Talking Points

- Japanese Yen tumbles as Australian Dollar gains on US-China trade deal bets

- US reportedly mulling lifting some Chinese import tariffs, Asia stocks may rise

- AUD/USD downtrend awaits the RBA, USD/JPY confines to bearish pattern

Find out what the #1 mistake that traders make is and how you can fix it!

BREAKING NEWS - US Mulls Lifting Some Chinese Tariffs

The Japanese Yen fell and the Australian Dollar rose after reports crossed the wires that the US is mulling removing some tariffs against China, increasing the prospect of a trade deal. According to a report from the Financial Times, this could amount to levies on about $112b which were enacted back in September at a 15 percent rate.

This is a welcome surprise after persistent requests from Beijing regarding the lifting of US tariffs. Furthermore, if there is follow-through, today’s update can pour cold water over doubts of a long-term US-China trade deal. S&P 500 futures are now pointing noticeably higher heading into Tuesday’s Asia Pacific trading session, suggesting a “risk-on” environment to come in regional bourses.

As such we may see the pro-risk Australian and New Zealand Dollar extend their advance, recovering from their lackluster performance on Monday. That appeared to have been attributed to broad strength in the US Dollar during the European and North American trading session as front-end government bond yields rose. Odds of a further 25-bp Fed rate cut by March 2020 did soften over the past 24 hours.

We saw the S&P 500 and MSCI Emerging Markets Index gap to the upside at the onset of the Wall Street trading session. But, their performance thereafter was rather lackluster. As such, the markets are likely prioritizing the cushioning impact US-China trade deal hopes have on global economic uncertainty. For the time being, monetary policy expectations are taking a back seat.

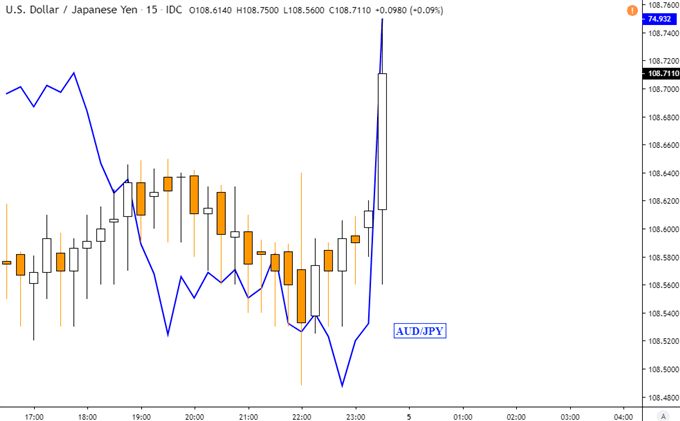

USD/JPY AND AUD/JPY RALLY ON US-CHINA TRADE NEWS

Chart Created Using TradingView

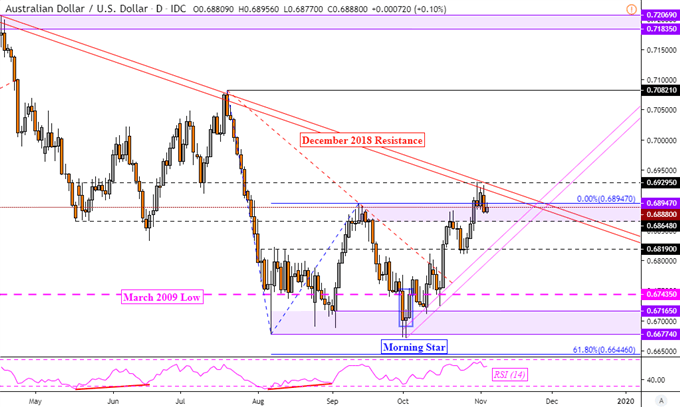

AUD/USD Technical Analysis

The AUD/USD dominant downtrend from the end of last year remains intact after descending resistance from December 2018 held. A daily close above this key psychological barrier opens the door to overturning persistent losses since then. But, fundamental follow-through would likely have to wait until the upcoming RBA interest rate decision passes as traders hesitate to commit to Aussie exposure.

Join Analyst Dimitri Zabelin for LIVE coverage of the RBA and reaction in the Australian Dollar at 3:15 GMT !

AUD/USD Daily Chart

Chart Created Using TradingView

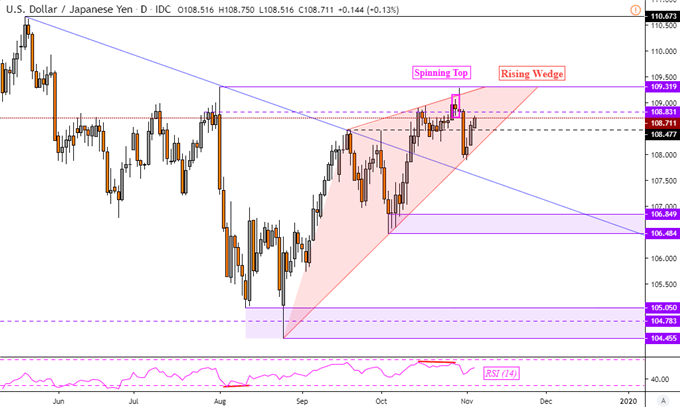

USD/JPY Technical Analysis

Meanwhile USD/JPY continues to trade within a Rising Wedge since the end of August. This is typically a bearish reversal formation where a daily close under the floor of the wedge opens the door overturning upside progress made over the past 2 months. For the time being, USD/JPY is aiming higher towards the ceiling where key resistance stands at 109.32.

USD/JPY Daily Chart

Chart Created Using TradingView

FX Trading Resources

- See how the Australian Dollar is viewed by the trading community at the DailyFX Sentiment Page

- See our free guide to learn what are the long-term forces driving the US Dollar

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter