Asia Pacific Market Open Talking Points

- Canadian Dollar reversal risk heightened after local CPI data beat

- Crude Oil fell on EIA inventory, US Dollar rose on FOMC minutes

- Australian, New Zealand Dollars may rise alongside Asia stocks?

Find out what the #1 mistake that traders make is and how you can fix it!

The Canadian Dollar was one of the best-performing majors over the past 24 hours, supported by better-than-expected local inflation data. In July, Canada CPI clocked in at 2.0% y/y versus 1.7% anticipated, the same pace as in June. This helped cool near-term Bank of Canada rate cut expectations, reflected in a rally seen in local front-end government bond yields.

Loonie gains were trimmed later as crude oil prices gave up earlier upside progress. The commodity faced selling pressure after weekly EIA oil inventory data showed a 2.73m b/d drawdown in stockpiles, smaller than the - 3.45m b/d API estimate. Gasoline inventories also unexpectedly rose. The commodity is a key source of Canadian revenue, and a decline in prices often carries implications for monetary policy.

Meanwhile, the US Dollar saw cautious gains after the FOMC minutes from the July interest rate cut. The document reiterated their easing efforts as a “mid-cycle adjustment”, stressing the need for flexibility. Local 2-year government bond yields rallied alongside the Greenback as odds of a 50-basis point cut in September faded. Stocks took a hit, but pared losses as markets await this week’s Fed economic policy symposium.

Thursday’s Asia Pacific Trading Session

With S&P 500 futures pointing cautiously higher after the index rose 0.82% on Wednesday, we may see Asia Pacific equities follow Wall Street higher. For the anti-risk Japanese Yen - which generally weakened over the past 24 hours - this may bode ill while supporting the sentiment-linked Australian and New Zealand Dollars. Though traders may hesitate to commit to large exposure ahead of the Jackson Hole Symposium.

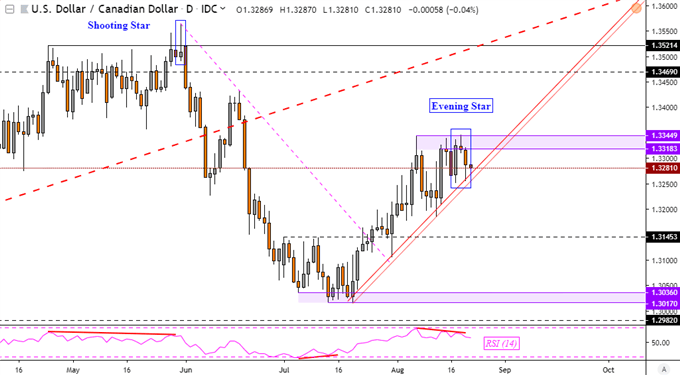

Canadian Dollar Technical Analysis

Wrapping it up with USD/CAD, the currency pair is at increasingly higher risk to a bearish reversal after another Evening Star candlestick pattern formed. Meanwhile, negative RSI divergence shows fading upside momentum which may precede a turn lower. A close under rising support from the middle of July opens the door to test 1.3145 down the road. Otherwise, resistance is a psychological range between 1.3318 and 1.3345.

USD/CAD Daily Chart

FX Trading Resources

- See how the S&P 500 is viewed by the trading community at the DailyFX Sentiment Page

- See our free guide to learn what are the long-term forces driving Crude Oil prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter