Asia Pacific Market Open Talking Points

- Canadian Dollar outperformed alongside the British Pound on Friday

- USD/CAD could be inching closer towards a reversal of its uptrend

- Asia Pacific equities may follow Wall Street higher as Yen weakens

Find out what the #1 mistake that traders make is and how you can fix it!

The sentiment-linked Canadian Dollar outperformed against its major counterparts on Friday as risk aversion cooled into the end of the week. Canada’s benchmark TSX Composite rose about 0.9 percent as Wall Street continued trimming losses from Wednesday when the Dow Jones Industrial Average experienced its worst performance in a single day since 2018.

The rosy mood in financial markets, especially from North America, followed rising bets of quantitative easing out of Europe and fading concerns of a “no-deal” Brexit that lifted the British Pound as well. In the US, we saw fading intensity in the inversion of the 10-year and 3-month yield curve. The United States is Canada’s largest trading partner and fading concerns of a recession in the former could boost CAD.

Canadian Dollar Technical Analysis

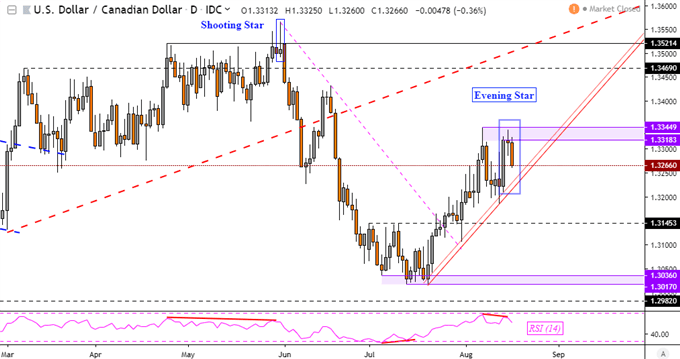

Taking a closer look at USD/CAD reveals increasingly bearish signals that may reverse the near-term uptrend from the middle of July. A bearish Evening Star candlestick pattern formed under resistance (1.3318 – 1.3345) as negative RSI divergence emerged. The latter shows fading upside momentum that can at times precede a reversal. This places the focus on rising channel support (parallel red lines below).

USD/CAD Daily Chart

Chart Created Using TradingView

Monday’s Asia Pacific Trading Session

With that in mind, a relatively quiet economic docket to begin the new trading week during Asia Pacific hours places the focus on risk trends absent sudden updates on the trade war front. APAC equities may echo gains from Friday’s Wall Street trading session, perhaps further pressuring the anti-risk Japanese Yen. Meanwhile, the pro-risk Australian and New Zealand Dollars may aim cautiously higher

FX Trading Resources

- See how the S&P 500 is viewed by the trading community at the DailyFX Sentiment Page

- See our free guide to learn what are the long-term forces driving Crude Oil prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter