Asia Pacific Market Open Talking Points

- USD may extend uptrend after 2Q US GDP beat after clearing resistance

- Alphabet and Twitter earnings propel S&P 500 as markets await the Fed

- British Pound fell, UK PM Boris Johnson wants Irish backstop removed

Not sure where the US Dollar is heading next? Check out the third quarter US Dollar fundamental and technical forecast !

The US Dollar outperformed against most of its major counterparts on Friday, propelled by better-than-expected second quarter US GDP data. GDP clocked in at 2.1% q/q versus 1.8% anticipated and from 3.1% prior. Personal consumption, which accounts for the vast majority of growth, rose 4.3% versus 4.0% expected and from 1.1% in the first quarter.

Local government bond yields rallied on the data and by the end of Friday, odds of a third Fed rate cut by year-end weakened. Yet, this was not enough to sour sentiment ahead of this week’s monetary policy announcement. The S&P 500 ended the day about 0.75% to the upside, particularly propelled by communication services.

This was thanks to gains in Alphabet (+10.45%) and Twitter (+8.92%) shares after solid earnings reports. Alphabet Inc., the parent company of Google, saw sales estimates beat expectations as their stock rose by the most since 2015. Meanwhile, Twitter saw better-than-expected revenue that caused their stock to increase by the most since April.

USD gains undermined the Australian and New Zealand Dollars, which were trading lower after a dose of risk aversion during Friday’s APAC session. The British Pound also underperformed on Brexit woes. Newly appointed UK Prime Minister Boris Johnson told French President Emmanuel Macron that the Irish backstop, a sticking point in withdrawal negotiations, “must be removed” from the divorce deal.

Friday’s Asia Pacific Trading Session

A lack of critical economic event risk at the beginning of a loaded week places the focus for FX on risk trends. We may saw Asia Pacific equities follow Wall Street higher which would translate into a cautiously optimistic mood for financial markets. This may end up boding ill for the anti-risk Japanese Yen as the US Dollar extends its advance.

US Dollar Technical Analysis

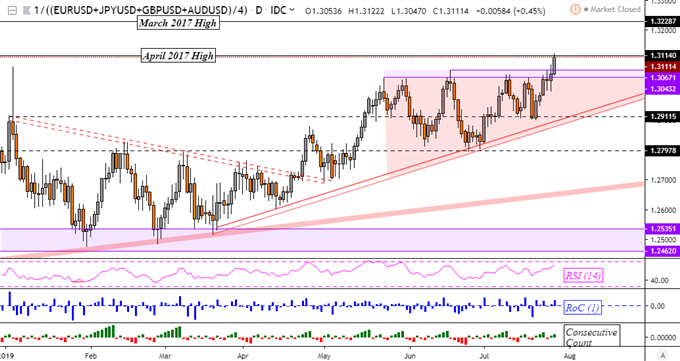

Last week, the US Dollar accelerated its long-term uptrend when comparing it to an equally-weighted basket of its top 4 liquid counterparts (EUR, JPY, GBP, AUD). Near-term resistance was taken out as prices stopped short of the April 2017 high. Closing above this opens the door to perhaps testing March 2017 highs given technical confirmation.

USD Index Daily Chart

Charts Created in TradingView

FX Trading Resources

- See how the S&P 500 is viewed by the trading community at the DailyFX Sentiment Page

- See our free guide to learn what are the long-term forces driving Crude Oil prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter