Asia Pacific Market Open Talking Points

- Gold prices target August 2013 high as US recession fears rise and bond yields fall

- NZDUSD and AUDUSD maintain gains despite S&P 500 struggle near record-highs

- GBPUSD lower as Boris Johnson comments on Brexit, Asia stocks may trade mixed

Trade all the major global economic data live as it populates in the economic calendar and follow the live coverage for key events listed in the DailyFX Webinars. We’d love to have you along.

Gold Prices Extends Rally as US Recession Fears Rise

Gold prices are up over 11 percent from the bottom in late April, extending recent aggressive behavior as US government bond yields continue falling in the aftermath of last week’s Fed monetary policy announcement. On Monday, it was no different as the anti-fiat precious metal climbed and the US Dollar aimed cautiously lower.

Yet, Wall Street was unable to capitalize on prospects of easing from the central bank, with a July interest rate cut fully priced in by Fed funds futures. The S&P 500 fell 0.17 percent as it kept struggling to hang on to a record-high close. The spread between 10-year and 3-month bond yields, which remains inverted since May 23, widened after narrowing for three days in a row, possibly indicating rising bets of a US recession.

Gold Technical Analysis

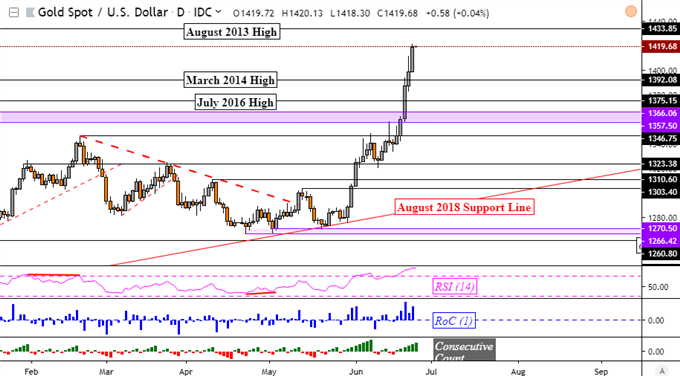

Looking at a gold daily chart, XAUUSD confirmed another close above the March 2014 high at 1392. Prices are quickly approaching the August 2013 high at 1433. From a technical standpoint, gold’s upside momentum picked up pace after testing the rising support line from August 2018, further solidifying it as key support in the event of a downturn in the medium-term.

Gold Daily Chart

*Charts Created in TradingView

Despite the rather lackluster performance in European and US equities, the pro-risk Australian and New Zealand Dollars aimed little higher. The former was boosted earlier in the day when RBA Governor Philip Lowe cooled near-term rate cut expectations. As for NZDUSD, it held to gains accumulated from Monday’s APAC session while capitalizing on Greenback weakness later in the day,

Tuesday’s Asia Pacific Session

Heading into Tuesday’s Asia Pacific trading session, S&P 500 futures are little changed with a slight downside bias. This points to a mixed session ahead as investors await this week’s crucial G20 summit for US-China trade updates. The British Pound is aiming cautiously to the downside after Boris Johnson, favored candidate for UK Prime Minister, said that Parliament is ready to back a “no-deal” Brexit.

FX Trading Resources

- See how gold is viewed by the trading community at the DailyFX Sentiment Page

- See our free guide to learn what are the long-term forces driving gold prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter