Asia Pacific Market Open Talking Points

- US-China trade war threats renewed as anti-risk Japanese Yen gains

- Markets could be looking at a repeat of Monday, Nikkei 225 at risk

- AUD/USD attempted downside break eyeing RBA, trade war news

Trade all the major global economic data live as it populates in the economic calendar and follow the live coverage for key events listed in the DailyFX Webinars. We’d love to have you along.

US-China Trade War Fears Linger On

After the past 24 hours saw a sudden revival in US-China trade war fears, sending stock markets across the world lower as the anti-risk Japanese Yen rose, Tuesday is looking to be no different. Not long after Monday’s Wall Street close, US Trade Representative Robert Lighthizer announced that the nation is due to increase Chinese tariffs come Friday with the targeted nation accused of reneging on trade deal provisions.

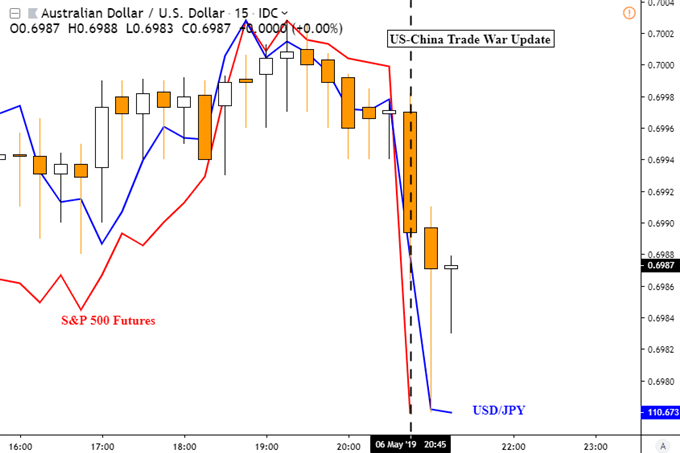

Looking at the immediate chart below, the pro-risk Australian Dollar declined against its US counterpart alongside S&P 500 futures as the trade news crossed the wires. USD/JPY also fell as the Yen added on to earlier gains. It is important to note however that the US will continue with negotiations with China, with a delegation team from the latter anticipated to arrive on Thursday.

AUD/USD, USD/JPY and S&P 500 Futures Fall on US-China Trade War Update

Chart Created in TradingView

Tuesday’s Asia Pacific Trading Session

With that in mind, foreign exchange markets seem to be poised for more volatility as we look towards Asia Pacific trade. Japanese bourses are coming online from a prolonged holiday and declines in Nikkei 225 futures hint that there may be weakness to come. On the plus side, this could potentially bode well for the Japanese Yen and to a certain extent the highly liquid US Dollar.

Will RBA Cut Rates, Send AUD/USD Lower?

AUD/USD is poised for volatility on the upcoming Reserve Bank of Australia monetary policy announcement because markets are expecting a rate cut from 1.50% to 1.25%. The central bank last did the same in August 2016, almost 3 years ago. But, these expectations are not terribly confidence-inspiring. Overnight index swaps are more or less pricing in about a 50% chance that the RBA could deliver a cut.

Regardless of the outcome, this means that roughly half of market participants will find themselves on the wrong end of the equation. This is an unmistakable ingredient for heightened Australian Dollar volatility. If the central bank surprises by holding rates unchanged, it may boost AUD/USD in the immediate sense. Down the road, it will be their forward guidance that clashes with US-China trade war updates steering the sentiment-oriented Aussie Dollar.

Join me as I cover the RBA rate decision LIVE and the reaction in the Australian Dollar where I will be also taking a look at what may drive it down the road!

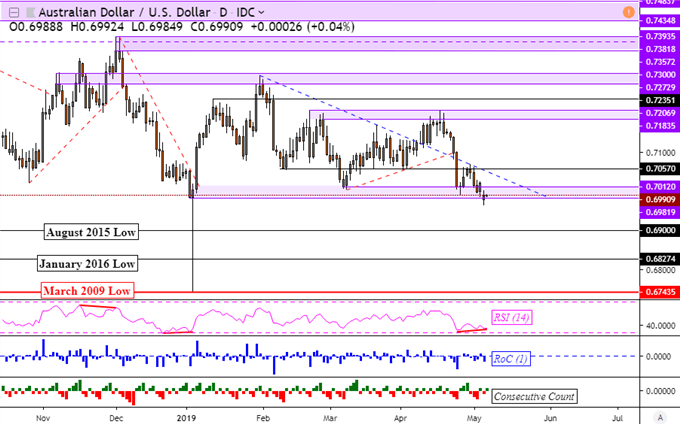

AUD/USD Technical Analysis

Taking this into consideration, the RBA and US-China trade war updates can determine whether the attempted downside breakout in AUD/USD could last. The pair broke under the early January close at 0.6982 with a downside gap on Monday. It has since closed back into the range of support on the chart below. Near-term resistance is under 0.7012. Positive RSI divergence, which shows fading downside momentum, does warn of a turn higher though.

AUD/USD Daily Chart

Chart Created in TradingView

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter