Asia Pacific Market Open Talking Points

- GBP/USD surged towards resistance on increased pressure for a Brexit deal

- US Dollar fell on mixed jobs report, S&P 500 rejoiced as bond yields dropped

- Asia Pacific equities may follow Wall Street higher as anti-risk Yen weakens

Trade all the major global economic data live as it populates in the economic calendar and follow the live coverage for key events listed in the DailyFX Webinars. We’d love to have you along.

FX News Friday

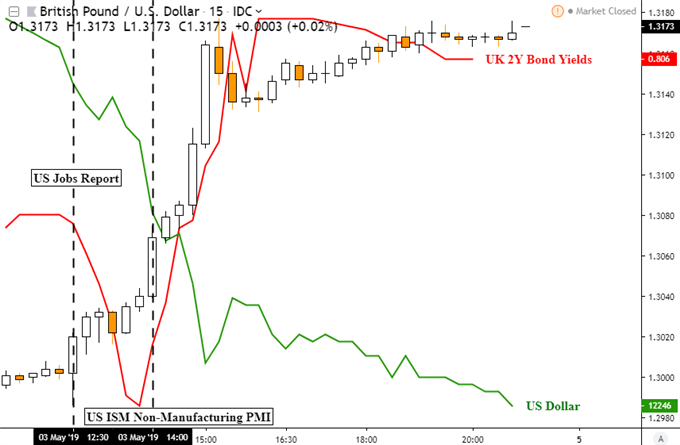

The British Pound easily took the spot as the best-performing major on Friday, experiencing a sudden burst of gains towards the end of the day. Puzzlingly, a clear catalyst seemed absent. Taking a look at the immediate chart below, we can see that GBP/USD gains accelerated once the last major event risk had passed ahead of the weekend, US ISM Non-Manufacturing PMI (which followed the jobs report).

GBP/USD Gains With BoE Rate Hike Bets

Chart Created in TradingView

Meanwhile, we know that earlier in the day the UK Conservative and Labour Parties lost seats in local elections, perhaps because of frustrated voters due to Brexit being delayed until October. On Thursday, Sterling largely brushed aside a hawkish Bank of England rate decision given the uncertainties of Brexit.

Perhaps the local elections served as a wake up call for both parties to reach an agreement on Brexit as soon as possible. This can boost the odds of a BoE rate hike and make GBP a relatively attractive currency in the context of a neutral Fed and what could be rate cuts from the RBA and RBNZ this week.

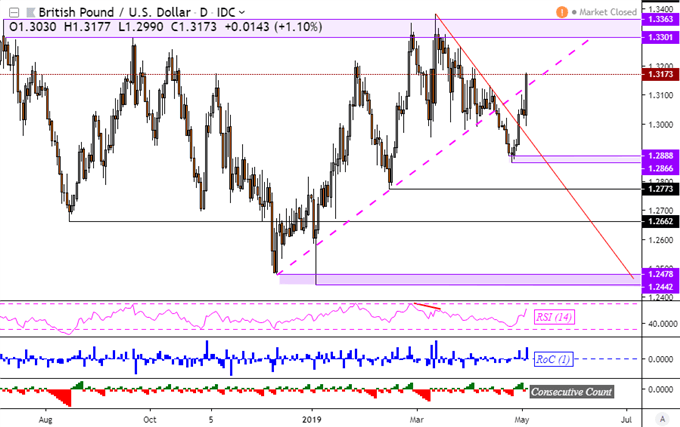

GBP/USD Technical Analysis

With that in mind, GBP/USD had its best day since March as the pair rose above the trend line that guided it higher from December to the middle of March. This also comes after clearing the near-term falling resistance line from March which sets GBP/USD up for another retest of the psychological barrier between 1.3363 and 1.3301 next.

GBP/USD Daily Chart

Chart Created in TradingView

Monday’s Asia Pacific Trading Session

There may be some market optimism to be had at the start of this week if Asia Pacific equities follow Wall Street higher. There, the S&P 500 saw gains in the aftermath of a mixed jobs report. While the nation added more jobs than expected and the unemployment rate ticked lower, the labor force participation rate softened. Perhaps discouraged workers exited the market, thereby pushing down unemployment.

Moreover, average hourly earnings disappointed relative to expectations. Given recent softer signals from the Fed’s preferred measure of inflation, the jobs report might have underlined a neutral Fed that isn’t ready to hike soon. The US Dollar fell alongside front-end government bond yields. With that in mind, don’t be too surprised if regional equities rise and the anti-risk Japanese Yen weakens.

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter