Asia Pacific Market Open Talking Points

- USD/CAD drops, eyeing support after rosy GDP data

- GBP/USD weakens as Brexit was delayed to April 12

- Asia stocks may rise with AUD/USD as JPY weakens

Find out what the #1 mistake that traders make is and how you can fix it!

Key FX News Friday

The Canadian Dollar was the best-performing major on Friday, bolstered by January’s local GDP report. At a time where most major countries are slowing, Canada’s economy should resilience as growth clocked in at 1.6% y/y versus 1.3% expected and from 1.1% in December. Local front-end government bond yields rallied, hinting at fading dovish Bank of Canada monetary policy expectations.

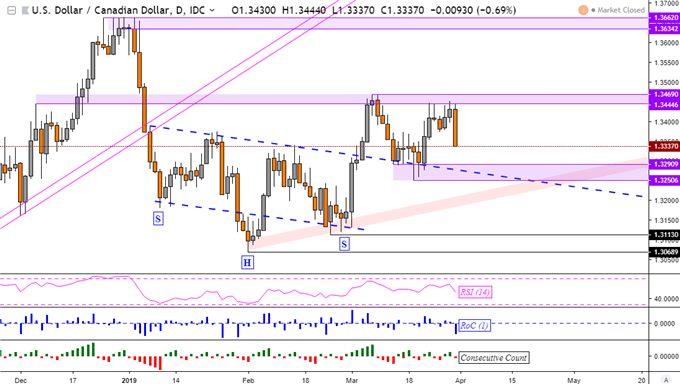

USD/CAD Technical Analysis

USD/CAD dropped about 0.7% on Friday in its worst single-day performance since February 22nd. This followed another retest of resistance just under 1.3469. This has left the pair eyeing near-term support which is a range between 1.3251 and 1.3291. Keep in mind that this area is also reinforced by former descending resistance from January (upper blue dashed line on the chart below).

USD/CAD Daily Chart

Chart Created in TradingView

On the flip side of the spectrum, the British Pound depreciated. For a third time, UK Prime Minister Theresa May failed to get her Brexit deal passed through Parliament. Even though MPs voted against a ‘no deal’ divorce previously, it was not legally binding. As such, leaving the EU without an agreement remains a possibility. For now, Brexit has been pushed back to April 12 on unconditional terms.

Monday’s Asia Pacific Trading Session

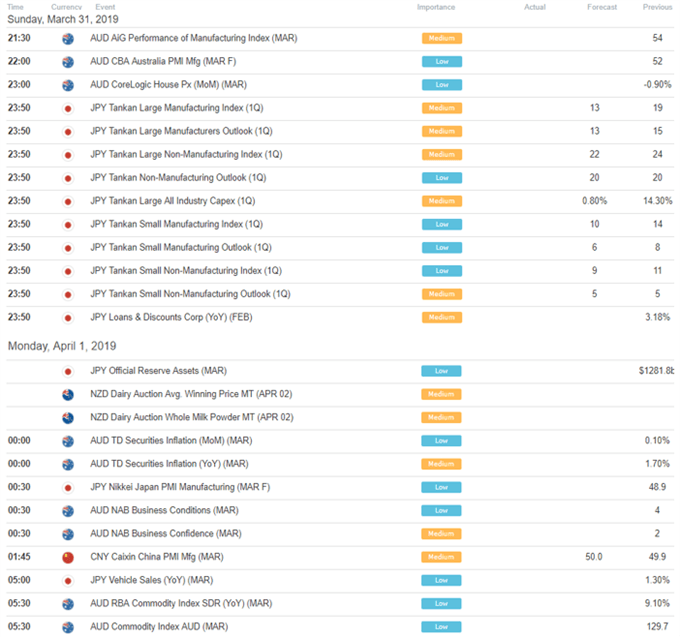

Monday’s Asia trading session contains a couple of event risk for the Australian Dollar such as local business confidence and Chinese Caixin PMI data. Risk trends will also be competing for Aussie’s focus. Wall Street edged higher on Friday, brushing off disappointing personal spending data. Markets may be eyeing US-China trade talks this week. With that in mind, a rosy day for equities may weaken the anti-risk Japanese Yen further as AUD/USD and NZD/USD climb.

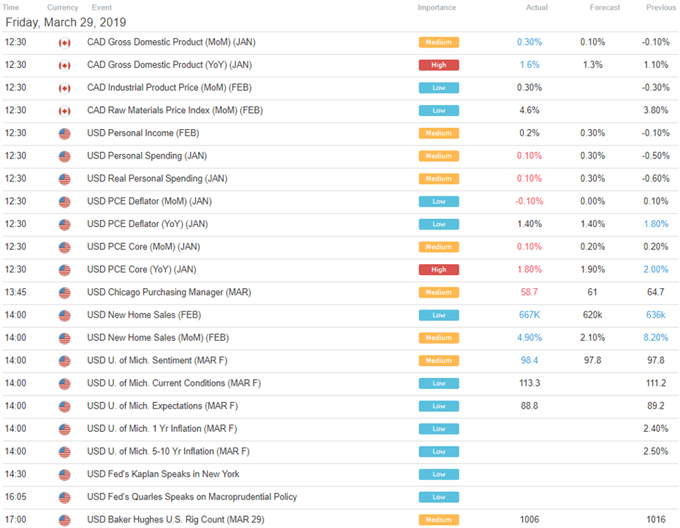

US Trading Session Economic Events

Asia Pacific Trading Session Economic Events

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter