Asia Pacific Market Open Talking Points

- British Pound gains as the UK Parliament forces votes on alternatives to Brexit

- GBP/USD dominant uptrend still holds but has been oscillating as of late

- Recession fears may still linger, offering upside potential for Japanese Yen

Find out what the #1 mistake that traders make is and how you can fix it!

GBP/USD Rallies, UK Parliament Forces Votes for Alternatives to Brexit Deal

The British Pound, which is expected to be the most active major, is off to a strong start in early Tuesday trade having just underperformed over the past 24 hours. A lot of what’s been keeping Sterling under pressure is the ongoing Brexit saga. Earlier in the day, UK Prime Minister Theresa May noted that she didn’t quite yet have the support to take her divorce deal back to Parliament for a third round.

GBP/USD then rose as the House of Commons passed a vote by 329 to 302 to seize control from Ms May over the Brexit process. It is forcing votes for alternatives to a Brexit deal which includes options such as avoiding it altogether or a second referendum. Last week, the EU agreed to allow only a brief Brexit extension until April 12 should May’s deal fail to pass in Parliament this week.

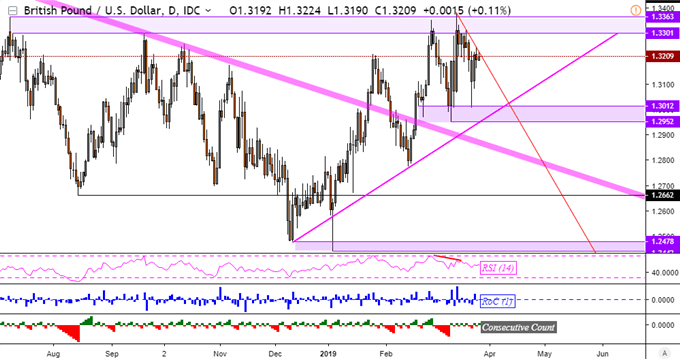

GBP/USD Technical Analysis

Taking a broader look at GBP/USD, the pair has largely been oscillating between a range of support (1.2952 – 1.3012) and a range of resistance (1.3301 – 1.3363) since late February. The dominant uptrend from December remains intact though, held together by a rising trend line from the end of last year. A near-term descending resistance line does appear to be guiding the pair lower towards 1.3012.

GBP/USD Daily Chart

Chart Created in TradingView

Tuesday’s Asia Pacific Trading Session

The anti-risk Japanese Yen is aiming narrowly lower against its major counterparts ahead of Tokyo stock exchange market open amidst the latest Brexit headlines. But, it is unclear at this point if market mood can significantly improve after Wall Street narrowly closed lower on Monday following increasing concerns about a recession on the horizon.

Tuesday’s Asia Pacific trading session lacks critical economic event risk, placing the emphasis on sentiment. US government bond yields continued tumbling in the prior session, likely reflecting a flight to safety as anti-fiat gold prices gained. As such, continued deterioration in market mood may once again offer a lift for the Japanese Yen.

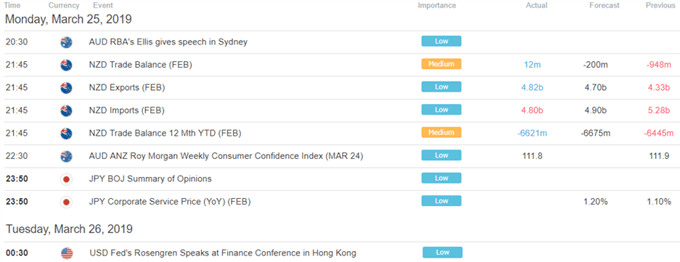

US Trading Session Economic Events

Asia Pacific Trading Session Economic Events

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter