Asia Pacific Market Open Talking Points

- Dismal French, Italian data soured sentiment but S&P 500 pulled through

- Canadian Dollar rallied as upbeat jobs report inspired BoC rate hike bets

- Nikkei 225 stall turns into a descent, now targeting December 2018 lows?

Trade all the major global economic data live and interactive at the DailyFX Webinars. We’d love to have you along.

3 Things to Know Before Trading APAC Markets

1 – Last Minute Recovery in S&P 500

Market mood soured considerably during the European trading session as the DAX closed at its lowest in over three weeks. This followed another round of disappointing economic data, French and Industrial production largely missed expectations. Keep in mind that the latter nation is in a technical recession and growth is slowing in Germany (the economic powerhouse of the EU).

There was a last-minute rally later in the day on Wall Street, but a clear catalyst seemed absent. The S&P 500 ended the day +0.07%, supported by tech shares (after gapping lower) but the Dow Jones Industrial Average closed -0.25% as expected. The pro-risk Australian and New Zealand Dollars aimed cautiously lower while the anti-risk Japanese Yen outperformed. The US Dollar was rather little changed.

2 – Canadian Dollar Rally on Jobs Report

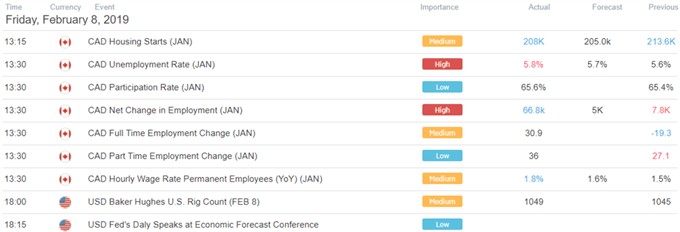

Despite the unemployment rate unexpectedly ticking higher to 5.8% in January from 5.6% in December, the Canadian Dollar soared. This was largely thanks to impressive gains in employment while the labor force participation rate edged higher (see first economic calendar below). Canadian front-end government bond yields rallied, suggesting a slight uptick in BoC rate hike bets.

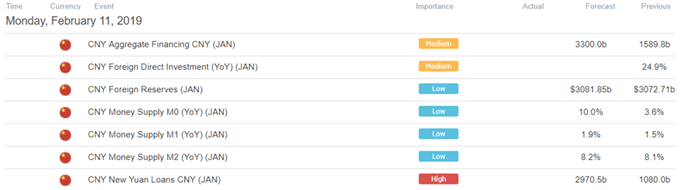

3 – Monday’s Asia Pacific Trading Session

As we begin the new trading week, Monday’s Asia Pacific trading session is lacking notable economic event risk. Meanwhile, Chinese stock exchanges should be coming online from the week-long holiday. This places the focus on sentiment. The mixed Wall Street session may echo into regional bourses. Though it seems that the market default in times of quiet headlines is risk aversion with the S&P 500 running out of reasons to rise.

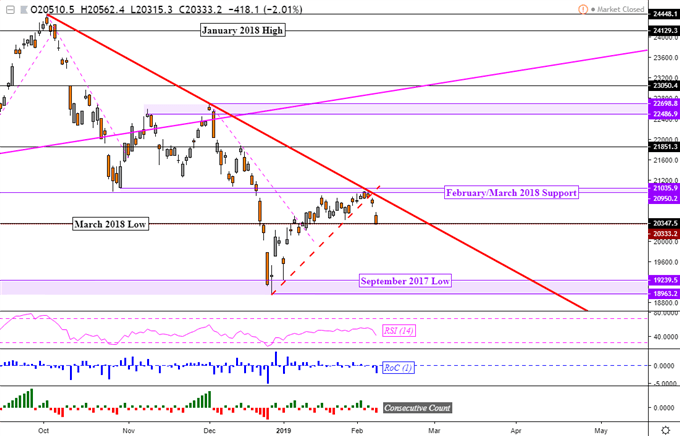

Nikkei 225 Technical Analysis

The Nikkei 225 turned lower after prices fell below a rising trend line as expected. On Friday, the Japanese benchmark stock index gapped lower and closed just under the March 2018 low at 20,347. This has exposed the December 2018 lows which could be targeted next at 19,239 – 18,963. For more timely updates, you may follow me on twitter @ddubrovskyFX for the latest market moves.

Nikkei 225 Daily Chart

Chart created In TradingView

US Trading Session Economic Events

Asia Pacific Trading Session Economic Events

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter