Asia Pacific Market Open – British Pound, Brexit News, Canadian Dollar, Australian Dollar, RBA

- British Pound continues outperforming on Brexit headlines, EUR/GBP resumed downtrend

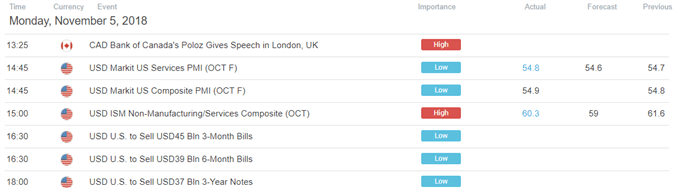

- CAD up on Poloz speech, US Dollar weakness. Gains pared as crude oil declined thereafter

- Australian Dollar may look past RBA, restrained market volatility as US 2018 midterms near

Check out our 4Q forecasts for equities in the DailyFX Trading Guides page

The British Pound headed higher against its major counterparts Monday, adding to gains it enjoyed at this week’s market open which were driven by Brexit headlines. This was then compounded by a pullback in the US Dollar during Wall Street trading hours. Perhaps reflecting an unwinding of positioning ahead of local midterm elections.

The Canadian Dollar was unable to hold on to gains following commentary from BoC’s Governor Stephen Poloz. He mentioned that their policy rate ‘will need to rise to neutral to hit target’, but local government bond yields were little changed. This suggests that BoC hawkish bets were not fueled. His speech did coincide with weakness in the US Dollar, perhaps explaining CAD gains.

But those were pared after crude oil prices declined later in the day despite the US sanctioning about 700 entities in Iran. The commodity initially rallied on the news, reflecting supply disruption concerns. Scretary of State Mike Pompeo did say that temporary oil wavers were issued to countries such as South Korea and China.

As Tuesday’s session began, reports crossed the wires that the EU will offer a compromise on the Irish border for UK Prime Minister Theresa May. As a result, EUR/GBP prices continued resuming the dominant downtrend after a bullish breakout attempt failed. The pair is eyeing range of horizontal support between 0.87237 and 0.87182.

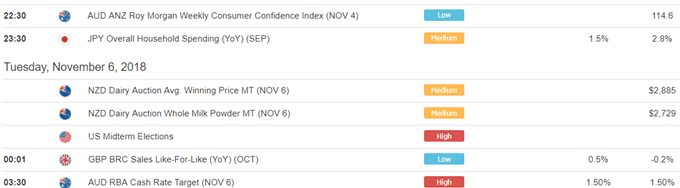

The Australian Dollar has been struggling to push above a descending resistance line from earlier this year, keeping the dominant downtrend intact. It is looking to today’s RBA rate decision next, but the event itself may pass without much fireworks given recent lackluster CPI data. In general, the Aussie has been primarily driven lately by risk trends and domestic political uncertainty.

I will be hosting live coverage of the RBA rate decision, covering Aussie crosses on Tuesday the 6th beginning at 3:15 GMT

With that in mind, given the close proximity of the 2018 US midterm elections, the Aussie Dollar may be more interested where market mood is going. We may see restrained volatility until the arguably more consequential event is behind us.

Fundamental Forecast:

New Zealand Dollar may sink as RBNZ leaves the door open to rate cuts

US Trading Session

Asia Pacific Trading Session

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter