Asia Pacific Market Open – US Dollar, FOMC Minutes, Australian Jobs Report, AUD/USD

- US Dollar had best day since September, fueled by GBP weakness and hawkish FOMC minutes

- US Treasury doesn’t label China as a currency manipulator, but APAC shares may still decline

- The Australian Dollar may look past the jobs report, focusing on more prominent external news

We recently released our 4Q forecasts for the US Dollar in the DailyFX Trading Guides page

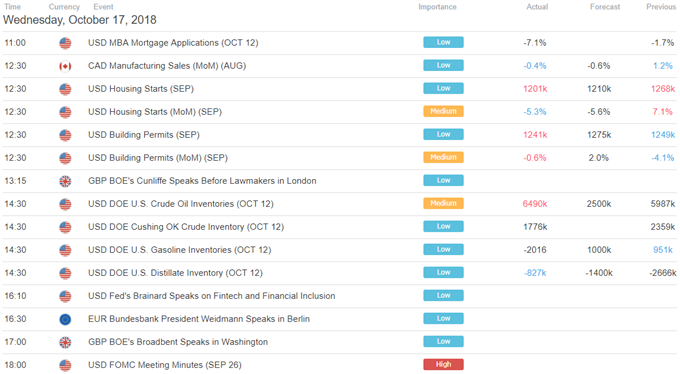

The US Dollar clocked in its best performance in a day since September 27th, rising about 0.6 percent. It was bolstered by weakness in the British Pound amidst softer-than-expected UK CPI data and perhaps Brexit pessimism bets ahead of the beginning of the EU leaders summit. Then, the US Dollar’s appreciation picked up pace as it rose with local government bond yields into the end of Wednesday.

The latter was partially fueled by the FOMC meeting minutes as expected. After last week’s market selloff, the central bank offered hawkish commentary. A number of officials said that they saw a need to hike above long-run levels and that a gradual approach balances the risk of going too fast or slow. December 2018 rate hike bets rose.

During the transition from Asia to Europe, we saw aggressive selloffs in the FTSE 100 and Stoxx 600, the latter was undermined by weakness in the auto sector as crude oil prices declined overnight. Given drops in European shares, we saw US equities trade lower after market open before correcting higher. However, the FOMC minutes capped those gains and the S&P 500 finished the day little changed.

As we moved to Thursday’s session, the US Treasury released its semiannual report on FX policies of key trading partners. In short, they did not label China as a currency manipulator and added that direct PBOC intervention ‘has been limited’. For the markets, this could be a sigh of relief as this may reduce the scope for the US to continue pushing trade wars against the world’s second largest economy for now.

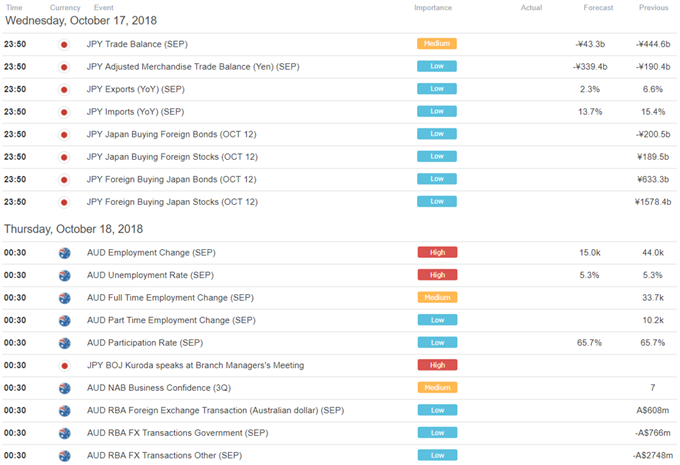

Despite this, we may see Asia Pacific benchmark stocks indexes trade lower as the dominant theme, which played a crucial part in last week’s stock crash, is arguably tightening global credit conditions. The FOMC minutes underpins this. Meanwhile the Australian Dollar may look past September’s jobs report given that the RBA remains patient before potentially raising rates next year. This undermines the impact of domestic economic data on monetary policy expectations and places the focus for AUD on external developments.

We will be covering the Australian jobs report as well as AUD/USD and other Aussie crosses during our live event webinar. You may sign up for it and tomorrow’s Chinese GDP report below.

Australian jobs report live webinar coverage (Begins 10/18 at 00:15 GMT)

Chinese GDP report live webinar coverage (Begins 10/19 at 01:45 GMT)

What Else to Expect Ahead?

Australian Dollar Technical Outlook

New Zealand Dollar Fundamental Outlook

US Trading Session

Asia Pacific Trading Session

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- See how the US Dollar is viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter