FOMC RATE DECISIONS & US DOLLAR VOLATILITY: EUR/USD, GBP/USD, USD/JPY, USD/CAD, AUD/USD, USD/CHF

- Fed meetings have historically sparked serious volatility in the US Dollar which could once again be the case considering the September FOMC Minutes Underscored a Divided Fed

- A FOMC rate decision is due Wednesday at 18:00 GMT and puts EUR/USD, GBP/USD, USD/JPY, USD/CAD and AUD/USD at risk of experiencing changes in spot prices that are above average

- Join DailyFX Chief Currency Strategist John Kicklighter for free live webinar coverage of the upcoming FOMC rate decision

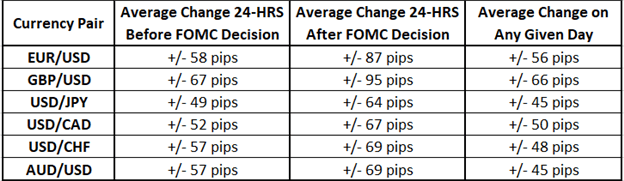

Forex traders should be on high alert whenever there is a Federal Reserve meeting on deck judging by historical US Dollar volatility surrounding a FOMC interest rate decision. Data pulled on spot EUR/USD, GBP/USD, USD/JPY, USD/CAD and AUD/USD since 2008 reveals that USD price action is particularly elevated surrounding a Fed monetary policy update. In fact, the average change (absolute value) in the 24-hours before and 24-hours after a FOMC rate decision is noticeably higher across the major US Dollar currency pairs listed in the table below when compared to average change on any given day.

FOMC RATE DECISIONS & AVERAGE US DOLLAR PRICE CHANGE (ABSOLUTE VALUE)

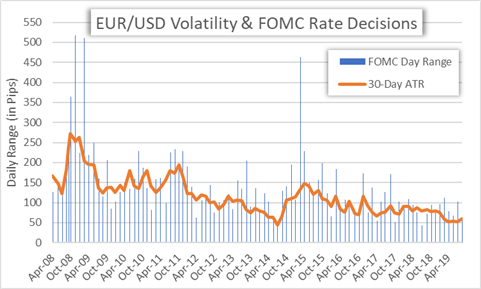

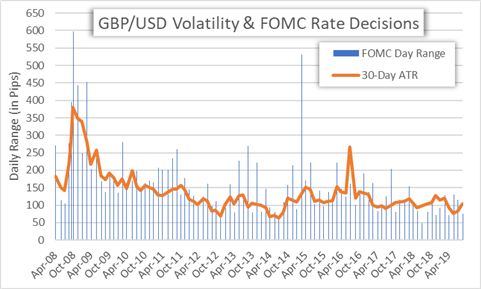

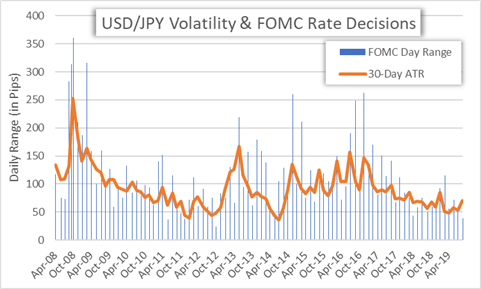

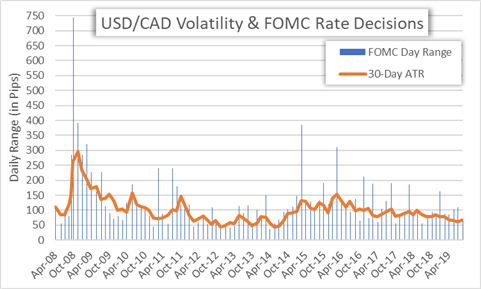

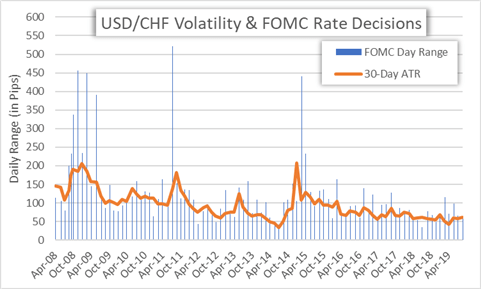

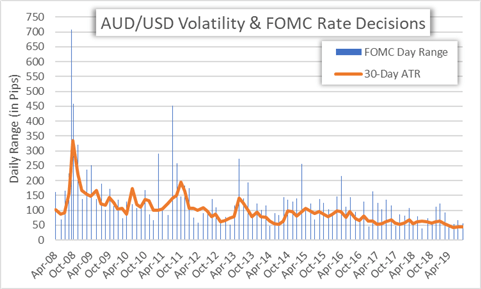

Another way to reflect US Dollar volatility around regularly held Fed meetings is by capturing the daily trading range on a FOMC decision day and comparing it to its respective 30-day average true range (ATR). Once again, we find that the US Dollar typically experiences above normal episodes of volatility in response to FOMC rate decisions.

EUR/USD PRICE VOLATILITY & FOMC RATE DECISIONS

GBP/USD PRICE VOLATILITY & FOMC RATE DECISIONS

USD/JPY PRICE VOLATILITY & FOMC RATE DECISIONS

USD/CAD PRICE VOLATILITY & FOMC RATE DECISIONS

USD/CHF PRICE VOLATILITY & FOMC RATE DECISIONS

AUD/USD PRICE VOLATILITY & FOMC RATE DECISIONS

The outcome of the analysis is the same irrespective of how the data is crunched to reflect US Dollar volatility surrounding a FOMC rate decision: the central bank’s monetary policy updates can act as a serious catalyst for USD price action. That said, forex traders should thoroughly consider implementing stringent risk management techniques when trading the US Dollar around a Fed meeting.

Check out the latest article detailing US Dollar Implied Volatility and Trading Ranges ahead of the October Fed meeting.

FOREX TRADING RESOURCES

- The IG Client Sentiment Report provides details on market positioning and insight on the bullish or bearish biases of traders across several forex pairs, commodities and indices

- Download the DailyFX Forecasts for comprehensive fundamental and technical analysis on major currencies like the US Dollar and Euro in addition to equities, gold and oil

- Sign up for Live Webinar Coverage of the financial markets hosted by DailyFX analysts where you can have all your trading questions answered in real-time

- Find out forex trading strategies behind the Top 10 Most Volatile Currency Pairs

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight