EURO PRESSURED AS SEPTEMBER ECB MEETING LOOMS

- The Euro is down roughly 0.5% on balance as selling pressure mounts headed into the ECB’s monetary policy update and speech from the central bank’s head Mario Draghi

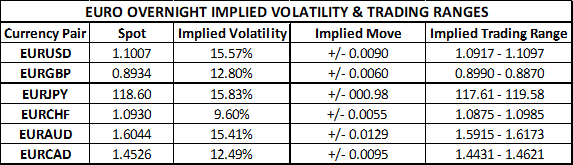

- EURUSD implied volatility skyrockets alongside readings for other major Euro currency pairs as uncertainty builds around what might be revealed at the September ECB meeting

- Join DailyFX for Live Market Coverage of the ECB interest rate decision

The Euro is crumbling with the European Central Bank (ECB) slated to provide its latest interest rate decision and monetary policy outlook Thursday at 11:45 GMT with ECB President Mario Draghi set to speak shortly after at 12:30 GMT. In light of the staggering event on deck surrounding the September ECB meeting, Euro implied volatility readings have surged as forex traders gear up for potentially sizable swings in EUR price action.

EURO SELLOFF ACCELERATING INTO ECB MONETARY POLICY UPDATE & DRAGHI SPEECH

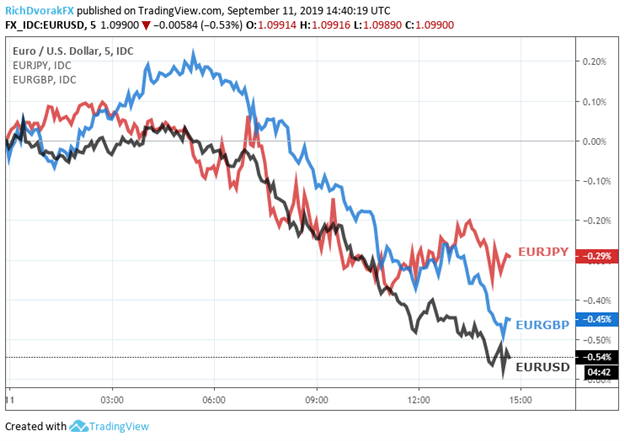

Chart created by @RichDvorakFX with TradingView

EURUSD is among the worst performing Euro currency pairs and is strong-arming the EXY Euro currency index noticeably lower with EURGBP and EURJPY following to downside as well. Euro selling pressure has accelerated largely owing to the market’s overarching dovish expectations that the September ECB meeting will reveal additional monetary policy accommodation.

ECB RATE CUT PROBABILITIES (SEPTEMBER 2019)

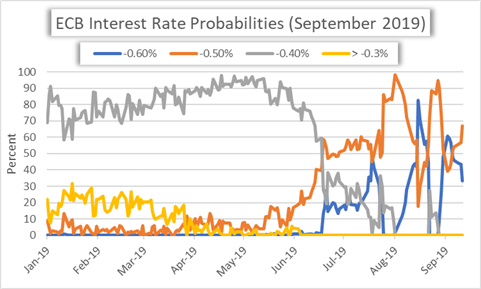

Bullish Euro prospects have dwindled in light of a dreary Eurozone economy and suppressed inflation expectations with Germany on the brink of an economic recession. In turn, a persistently sluggish Euro-area economic backdrop has fueled an acceleration in ECB rate cut bets with markets currently pricing in a 66.8% probability of a 10bps rate cut and 33.2% probability of a more aggressive 20bps reduction in its key deposit facility rate from the current -0.4%. Correspondingly, spot EURUSD sank to its lowest level since May 2017 earlier this month.

EURO IMPLIED VOLATILITY & TRADING RANGES: EURUSD, EURGBP, EURJPY, EURCHF, EURAUD, EURCAD

While certain members of the ECB called for an aggressive stimulus package recently like Finnish central banker Olli Rehn, others who hold less dovish views have voiced doubts over the need to provide further monetary policy accommodation. As such, the lack of clarity around the ECB’s next move has sent overnight Euro implied volatility measures skyrocketing to levels not seen in over a year. We detailed yesterday the potential for heightened Euro price action over the short-term with EURUSD set to gyrate on ECB monetary policy uncertainty.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight