Talking Points:

- The BOE’s decision to keep rates on hold today marks the culmination of a tumultuous few weeks of trading for the British Pound.

- Three weeks ago, odds for a 25-bps rate hike in May were 85%; now, rates markets are barely pricing in one hike in 2018 at all.

- See the full DailyFX Webinar Calendar for upcoming strategy sessions.

Looking to learn more about how central banks impact FX markets? Check out the DailyFX Trading Guides.

The British Pound has been in meltdown mode for the past three weeks, following rate hike expectations every step of the way. On April 19, odds of a 25-bps hike at the May policy meeting were still at 85%, and GBP/USD above 1.4300. But since then, GBP/USD has dropped closer to 1.3500, culminating in the BOE’s May decision to keep their main policy rate on hold at 0.50%.

This has been a dramatic change in fortunes, no doubt. And despite BOE Governor Mark Carney’s suggestion that a rate hike will still happen at some point this year, traders seem to have embodied the mantra “once bitten, twice shy.”

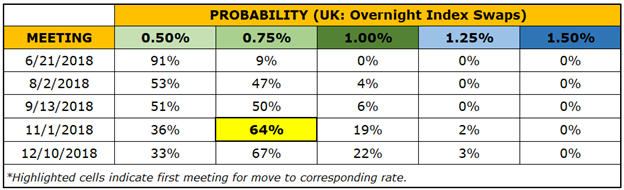

Rates markets are only pricing in 19-bps of tightening for the remainder of 2018, with the November policy meeting – one of the four per year that is accompanied by a new Quarterly Inflation Report (QIR) – being seen as the most likely period for when the hike would occur (64% implied probability).

Table 1: BOE Rate Hike Expectations (May 10, 2018)

If the “once bitten, twice shy” mantra is indeed the motif for traders now, then it will take more than Governor Carney’s suggestion of a hike to move pricing. Indeed, between the dismal Q1’18 UK GDP report and recent inflation (CPI, PPI, and RPI) trends, traders will want to see hard evidence that economic data is back on track before taking any more policy officials at face value about the timing of another rate hike.

GBP/USD Price Chart 1: Daily Timeframe (January 2017 to April 2018)

With rate hike odds continuing to erode, this leaves the British Pound in a difficult situation. Technically, the damage has been significant as well: a double top may now be in the works. Price broke the uptrend dating back to the January 2017, with momentum accelerating to the downside: price is below the daily 8-, 13-, and 21-EMA envelope, with MACD and Slow Stochastics trending lower in bearish territory.

The double top pattern (depending upon the highs/lows used as a baseline) calls for price to return to the October and November 2017 lows near 1.3027.

Needless to say, for the British Pound to stage any sort of significant recovery moving forward, it desperately needs rate expectations to pick back up. Movement in the August pricing (another meeting in which a QIR will be produced) in the near-term will be crucial to the direction of Pound Sterling.

Read more: US Dollar Rally Stalls but Uptrend to Remain in Place

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher's e-mail distribution list, please fill out this form