GOLD, XAU/USD, US DOLLAR, REAL YIELDS, INFLATION - Talking Points

- Gold has managed to find some traction as markets weigh recession risks

- The US Dollar and yields have dipped, giving gold a boost for now

- If the Fed hikes as expected this week, will XAU/USD benefit?

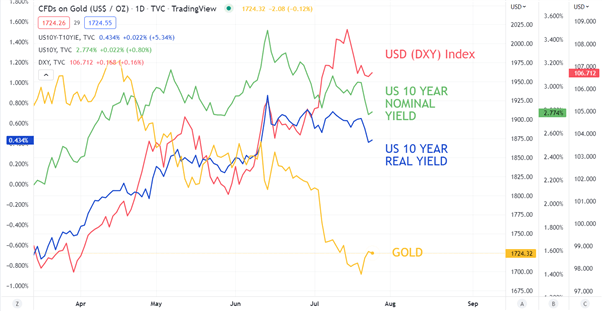

Gold managed to rally going into the end of last week as the US Dollar softened. US nominal yields and US real yields also went lower, assisting the gold price.

Later this week the Federal Reserve are expected to raise rates by 75 basis points (bps) according to pricing in the futures market and from overnight index swap (OIS) prices.

There seems to be a growing perception in the market that perhaps the Fed has done enough front-end loading of rate hikes to get the job done on reining in ‘eye watering’ inflation.

While Treasury Secretary Janet Yellen played down the risk of recession last week, the oft cited experience of the Fed in the early 1980s would suggest otherwise.

In that era, Fed Chair Paul Volker had the support of both the Carter and Reagan administrations to extinguish extremely high inflation. He did this by tightening monetary conditions aggressively and his tactics were successful.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

It was this experience that has led to many central banks entrenching an asymmetric bias with their monetary policy framework. This leaning allows for the risk of high inflation in order to stimulate maximum sustainable growth.

The successful containment of inflation in the 1980s came at the cost of two recessions. The Fed has never been able to lower inflation by more than 2% without a recession. With that in mind, if the Fed has rates high enough and that occurs, they will have some ammunition to stoke economic activity.

The market appears to be coming to this understanding when looking at Treasury yield, particularly in the 2 to 10-year part of the curve. Yields there dropped by 11-15 bps on Friday.

The lowering of Treasury yields could see US Dollar weakness unwind. Although, this would also see a potential risk off environment that would be supportive of the US Dollar. It is this dilemma that seems to be creating a crossroads for markets generally and for the gold price.

GOLD AGAINST US 10-YEAR REAL YIELD,US 10-YEAR NOMINAL YIELD, USD (DXY) INDEX

Introduction to Technical Analysis

Moving Averages

Recommended by Daniel McCarthy

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter