CRUDE OIL FUNDAMENTAL FORECAST DOWNGRADED FOR Q3

- WTI crude oil prices surged 25% in 2Q largely owing to supply-demand imbalances

- OPEC+, Iran nuclear deal could drive an increase in crude oil production during Q3

- Oil price action could face headwinds from seasonal factors or risks materializing

Crude oil prices made an explosive move higher during 2Q-2021. On balance, WTI and Brent oil surged about 25% and 21% over the last three months respectively. This aligned with our bullish fundamental forecast for the second quarter, which was largely predicated on the prospect of accelerating demand amid vaccination and reopening efforts. Due to the likelihood that bullish drivers start to sputter, however, crude oil outlook seems less sanguine for 3Q-2021. Such has already been the case with crude oil price action down nearly -10% so far this month as the commodity plunges into critical support.

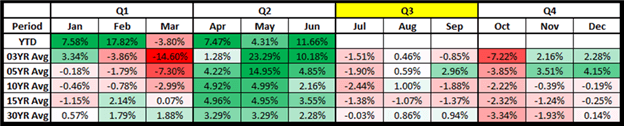

Third Quarter Seasonality Points to Less Favorable Conditions for Crude Oil Prices

Historically speaking, crude oil tends to perform quite well throughout Q2 and often faces headwind in Q3. This is illustrated by the crude oil seasonality table above. Seasonally less favorable conditions for crude oil could be one force that works against bullish impetus. Average seasonal performance is arguably neutral on balance during the months of July, August, and September. Correspondingly, signs of fading upward momentum for crude oil might motivate momentum traders and speculators betting on higher prices to start unwinding their positions. That could weigh negatively on the commodity’s direction in turn.

| Change in | Longs | Shorts | OI |

| Daily | 8% | -17% | 0% |

| Weekly | 37% | -35% | 6% |

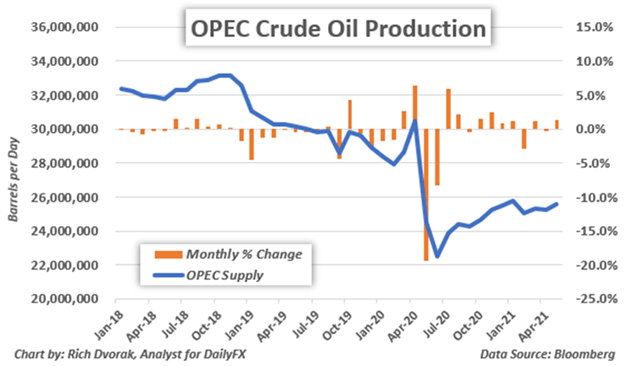

OPEC & Allies Unwinding Oil Production Cuts, Iran Nuclear Deal to Unleash Supply

More importantly, the broader direction of crude oil price action during Q3-2021 likely hinges on supply considerations from OPEC and its allies. The cartel of oil producers is expected to continue unwinding voluntary output cuts made in the wake of the covid pandemic. To be fair, this increase in oil production is anticipated to be gradual, and the oil market is very tight due to excess demand right now.

Key OPEC ministers, like Saudi Arabia’s Prince Abdulaziz, have voiced how there is a ‘need to be cautious’ with bringing back supply too. This will require considering odds of an Iran nuclear deal being reached, which would lift sanctions and see the country’s oil exports possibly double from about 1-million/bpd to 2-million/bpd. That said, crude oil prices have potential to face downward pressure in 3Q due to the risk of rising oil output.

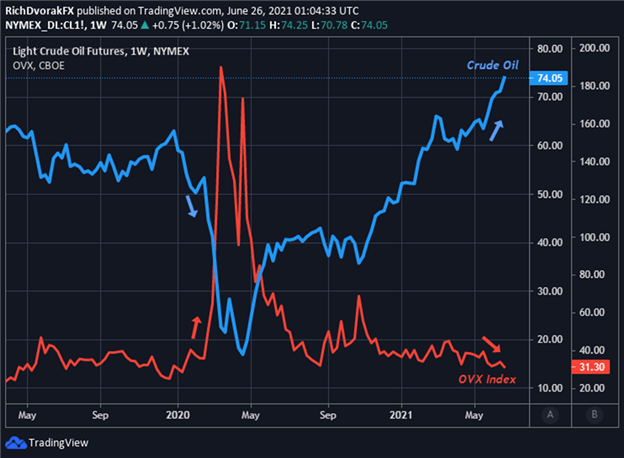

OVX Compression Risks Brewing Complacency to the Threat of New Covid Variants

Chart by @RichDvorakFX created using TradingView

It is also worth mentioning that relatively low readings of implied volatility can suggest that the market is beginning to grow complacent. After all, volatility, much like the economy, behaves in cycles. Relatively subdued volatility levels are likely to eventually mean-revert higher while comparatively elevated measurements of volatility are likely to normalize back lower. If market sentiment deteriorates broadly, that would likely send measures of volatility, like the OVX Index, snapping higher and crude oil price action tumbling lower in accordance. This brings to focus the possibility that the market may be underappreciating covid-variant risks.

To that end, it seems as though the covid delta-variant is becoming a more prevalent concern of the public. New cases of this strain have been rising rapidly, leading to delays of reopening efforts and even new lockdowns, yet the market has barely batted an eye. Seeing that renewed restrictions on economic activity to curb the spread of covid would likely send oil demand and prices sharply lower, this space is surely worth keeping near the top of the radar for crude oil outlook.

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight