Sentiment Indicators: Using IG Client Sentiment

The IG Client Sentiment (IGCS) is unique, proprietary and potentially helpful to traders. The article will outline the following illustrative points:

- What is IG Client Sentiment (IGCS)?

- Sentiment Indicators

- IGCS as a Leading Indicator

- IGCS as a Technical Indicator: Summary

What is IG Client Sentiment (IGCS)?

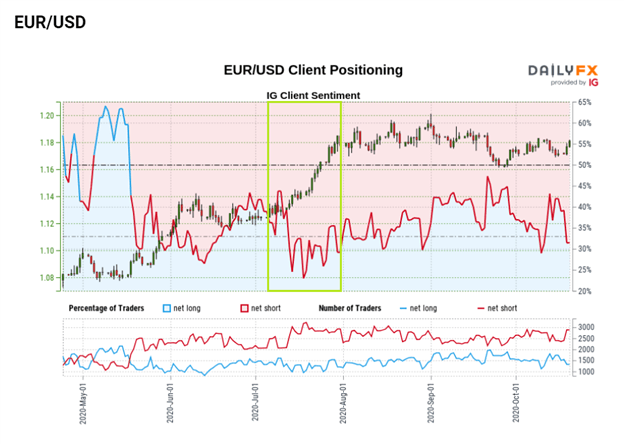

IG Client Sentiment (IGCS) is a tool that traders can use in conjunction with a broader technical and/or fundamental strategy. IGCS incorporates retail trader positioning (long and short) to formulate a sentiment bias. This is represented in percentage form (see image below) which aids traders in identifying market imbalances which could lead to possible opportunities.

IGCS on EUR/USD:

Sentiment Indicators

Sentiment indicators are few and far between. The two most well-known are open interest in options, which largely applies to stocks, and the Commitment of Traders Report (CoT). What sets IGCS apart is the large sample size of retail traders which deliver more usable data in terms of indicator readings, multiple market data sets (FX, equities commodities) and timely updates for these markets which are refreshed several times daily.

IGCS as a Leading Indicator

The use of IGCS as a technical indicator can allow traders to confirm or refute signals produced by their wider trading strategy. Both fundamental and other technical techniques are used to gauge trends, ranges, potential reversals etc. so incorporating IGCS provides another layer of data to help verify a hypothesis.

IGCS can be considered as a leading indicator as it uses past and current data to project possible future price movements however, as IGCS (retail) covers only one component of the market equation, traders should not rely solely on the IGCS tool for trading decisions. Simply put, retail traders contribute only a certain percentage of market input so naturally other factors will have influence on the respective market.

For example, the EUR/USD chart below shows the projectible nature that can occur with IGCS. The highlighted are on the chart exhibits an increase in net short positions from retail traders which coincided with a rise in price action (EUR appreciation) on the price chart itself.

IGCS EUR/USD:

IGCS as a Technical Indicator: Summary

We have shown how sentiment/IGCS can be a unique, proprietary and potentially helpful addition to a trader’s approach. In subsequent IGCS articles in this market sentiment sub-module, we will go through the implementation and flexibility of this tool in varying trading circumstances.

Looking to trade in a simulated environment to better learn strategies, tactics and approach? Click here to request a free demo with IG group.