Indian Rupee, USD/INR, Nifty 50, RBI Rate Decision - Talking Points

- Indian Rupee gains, Nifty 50 a little weaker on RBI rate decision

- The central bank left key rate unchanged after fiscal splurge news

- USD/INR eyeing key support, but downside momentum is fading

The Indian Rupee gained slightly against the US Dollar after the Reserve Bank of India (RBI) left the benchmark repurchase rate at 4% in February as expected. There was some room for a surprise here as about 20% of Bloomberg survey respondents priced in a cut. The Nifty 50, the nation’s key stock market index, was aiming cautiously lower, perhaps on some disappointment for those expecting some easing.

December’s CPI print surprised lower, clocking in at 4.6% y/y as inflation fell closer towards the midpoint of the RBI’s target range. This likely contributed to rising calls for further easing, which is why some investors were caught off guard in January when the central bank tried to shore up some excess liquidity. Then, the RBI withdrew US$27.3 billion via a 14-day reverse repo auction.

But, the central bank reiterated today that their liquidity stance continues to be accommodative, adding that they are committed to ample amounts of it being available in the system. Governor Shaktikanta Das noted that the growth outlook significantly improved, with fiscal-year 2022 GDP seen at 10.5%. Inflation is seen at 5.2% for the fourth quarter after rising from 4.3% in the third one.

More importantly, the RBI’s action today comes after the government recently revealed an unexpectedly large budget worth 9.5% and 6.8% of GDP in fiscal years 2021 and 2022, respectively. This may have eased some pressure off the central bank to reduce rates further, but today’s decision clearly highlighted its ongoing dovish stance. Ahead, USD/INR and the Nifty 50 turn to January’s CPI print, due at 12:00 GMT on February 12th.

Check out the DailyFX Economic Calendar for updates on market-moving data

Indian Rupee Technical Analysis

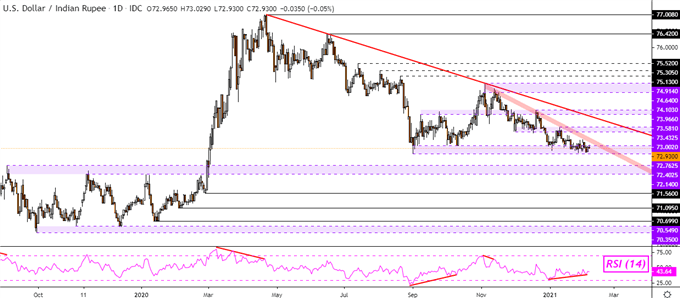

USD/INR is facing the key 72.7625 – 73.0020 support zone that has been holding since late August. Positive RSI divergence has been emerging though, showing that downside momentum is fading. This could precede a turn higher. Maintaining the focus to the downside since November has been a falling range of resistance – see chart below. A break above it exposes the 73.4325 – 73.5810 inflection zone towards long-term falling resistance from April. Otherwise, further losses exposes the 72.1400 – 72.4025 inflection range.

USD/INR Daily Chart

USD/INR Chart Created in TradingView

Nifty 50 Technical Analysis

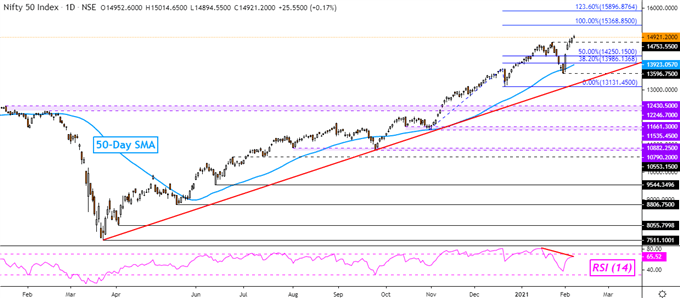

The Nifty 50 continues to push into record highs, but negative RSI divergence shows that upside momentum is fading. A turn lower here may place the focus on the January high at 14753. Beyond that sits the 50-day Simple Moving Average which may maintain the focus to the upside. Otherwise, further gains may see prices reach the 100% Fibonacci extension at 15368.

Nifty 50 Daily Chart

Nifty 50 Chart Created in TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter